The following selected events occurred in the general fund of the Village of Sleepy Hollow during the

Question:

The following selected events occurred in the general fund of the Village of Sleepy Hollow during the fiscal year ended June 30, 20X6:

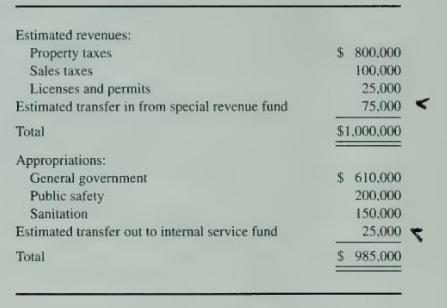

1. The operating budget included the following resource inflows and outflows:

2. Sleepy Hollow uses the lapsing method of accounting for encumbrances. The appropriations included encumbrances of \(\$ 18,000\) related to the year ended June 30, 20X5.

3. The property tax levy was \(\$ 816,000\), and estimated uncollectibles were \(\$ 16,000\).

4. Property taxes of \(\$ 805,000\) were collected. The estimated uncollectibles balance was decreased to \(\$ 6,000\), and the remaining receivables and allowance were reclassified to delinquent at yearend.

5. Received \(\$ 102,000\) of sales tax revenue from the state and \(\$ 24,000\) from licenses and permits.

6. Received transfer in of \(\$ 70,000\) from a special revenue fund. Made a \(\$ 25,000\) transfer out to establish an internal service fund. For both of these transactions, record the interfund receivable/payable before recording the cash transfer.

7. Ordered computer equipment costing \(\$ 50,000\). Received computer equipment and paid the actual cost of \(\$ 50,500\) two weeks after receipt of the equipment.

8. Made a loan to an enterprise fund for \(\$ 20,000\) on January \(1,20 \mathrm{X} 6\). The loan was repaid with interest at 6 percent on June 30, 20X6.

9. Used the services of the central motor pool and was billed \(\$ 500\). The bill was paid within one week of its receipt by the general fund.

\section*{Required}

Prepare journal entries for the general fund to record these transactions involving the Village of Sleepy Hollow for the year ended June 30, 20X6.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King