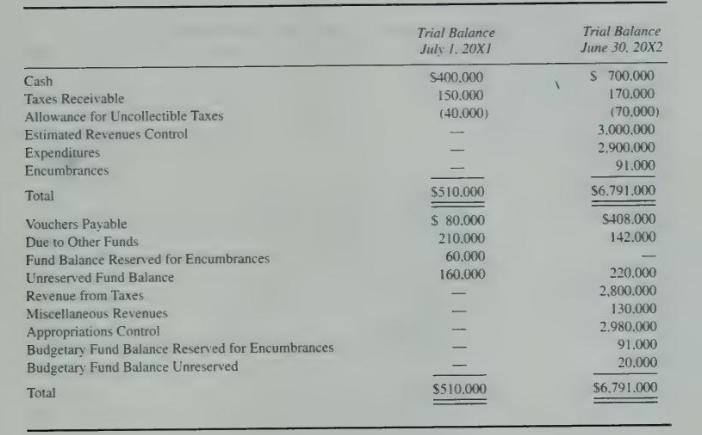

The trial balances shown below were taken from the accounts of the Omega City general fund before

Question:

The trial balances shown below were taken from the accounts of the Omega City general fund before the books had been closed for the fiscal year ended June 30, 20X2:

1. The estimated taxes receivable for the year ended June \(30.20 \times 2\), were \(\$ 2.870,000\), and the taxes collected during the year totaled \(\$ 2.810 .000\). Miscellaneous revenue of \(\$ 130.000\) was also collected during the year.

2. Encumbrances in the amount of \(\$ 2,700,000\) were recorded. In addition, the \(\$ 60,000\) of lapsed encumbrances from the 20X1 fiscal year was renewed 3. During the year. the general fund was billed \(\$ 142.000\) for services performed on its behalf by other city funds (debit Expenditures).

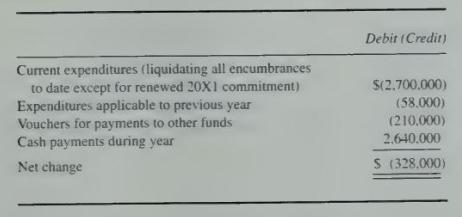

4. An analysis of the transactions in the Vouchers Payable account for the year ended June 30. \(20 \times 2\), is as follows:

5. On May 10, 20X2. encumbrances were recorded for the purchase of next year's supplies at an estimated cost of \(\$ 91.000\).

\section*{Required}

On the basis of the data presented, reconstruct the original detailed journal entries that were required to record all transactions for the fiscal year ended June \(30,20 \mathrm{X} 2\), including the recording of the current year's budget. Do not prepare closing entries for June 30, 20X2.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King