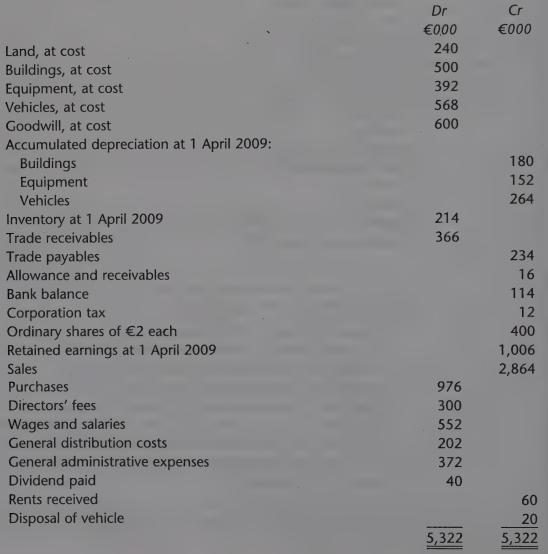

The following trial balance is extracted from the books of Walrus plc as at 31 March 2010:

Question:

The following trial balance is extracted from the books of Walrus plc as at 31 March 2010:

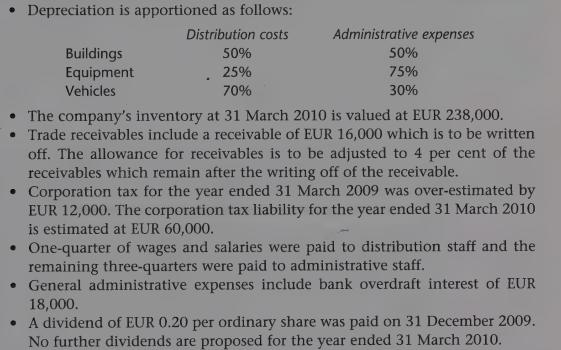

Additional information:

• The company’s non-depreciable land was valued at EUR 600,000 on 31 March 2010 and this valuation is to be incorporated into the accounts for the year ended 31 March 2010.

• The company’s depreciation policy is as follows:

In all cases, a full year’s depreciation is charged in the year of acquisition and no depreciation is charged in the year of disposal. None of the assets had been fully depreciated by 31 March 2009.

One February 2010, a vehicle used entirely for administrative purposes was sold for EUR 20,000 for cash. The vehicle had cost EUR 88,000 in August 2006. This was the only disposal of a non-current asset, made during the year ended 31 March 2010.

Prepare the following financial statements for Walrus plc in accordance with the requirements of IAS 1 (revised):

(a) a statement of comprehensive income for the year ended 31 March 2010;

(b) a statement of financial position as at 31 March 2010;

(c) a statement of changes in equity for the year ended 31 March 2010.

Step by Step Answer:

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone