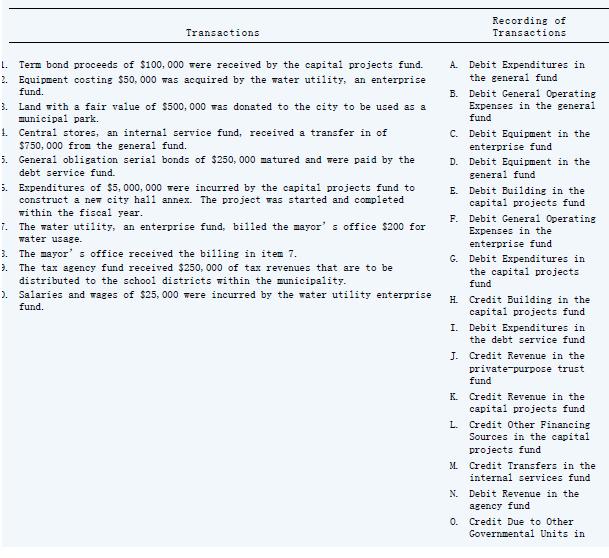

The numbered items on the left consist of a variety of transactions that occur in a municipality.

Question:

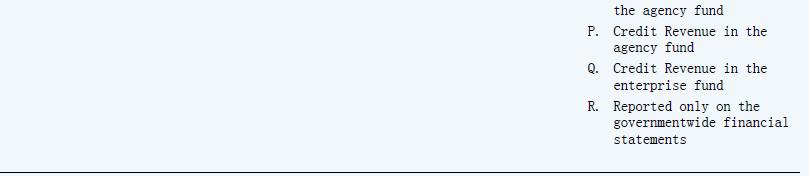

The numbered items on the left consist of a variety of transactions that occur in a municipality. The lettered items on the right consist of various ways to record the

transactions. Select the appropriate method for recording each transaction. Some transactions have more than one correct answer. Lettered items may be used once,

more than once, or not at all.

Transcribed Image Text:

Transactions 1. Term bond proceeds of $100,000 were received by the capital projects fund. 2. Equipment costing $50,000 was acquired by the water utility, an enterprise fund. 3. Land with a fair value of $500,000 was donated to the city to be used as a municipal park. 1. Central stores, an internal service fund, received a transfer in of $750,000 from the general fund. 5. General obligation serial bonds of $250,000 matured and were paid by the debt service fund. 5. Expenditures of $5,000,000 were incurred by the capital projects fund to construct a new city hall annex. The project was started and completed within the fiscal year. 7. The water utility, an enterprise fund, billed the mayor's office $200 for water usage. Recording of Transactions A. Debit Expenditures in the general fund B. Debit General Operating Expenses in the general fund C. Debit Equipment in the enterprise fund D. Debit Equipment in the general fund E. Debit Building in the capital projects fund F. 3. The mayor's office received the billing in item 7. 3. The tax agency fund received $250,000 of tax revenues that are to be distributed to the school districts within the municipality. ). Salaries and wages of $25,000 were incurred by the water utility enterprise fund. Debit General Operating Expenses in the enterprise fund G. Debit Expenditures in the capital projects fund H. Credit Building in the capital projects fund I. Debit Expenditures in the debt service fund J. Credit Revenue in the private-purpose trust fund K. Credit Revenue in the capital projects fund L. Credit Other Financing Sources in the capital projects fund M. Credit Transfers in the internal services fund N. Debit Revenue in the 0. agency fund Credit Due to Other Governmental Units in

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

Answered By

GERALD KAMAU

non-plagiarism work, timely work and A++ work

4.40+

6+ Reviews

11+ Question Solved

Related Book For

Advanced Financial Accounting

ISBN: 9781260165111

12th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd

Question Posted:

Students also viewed these Business questions

-

Which of the following statements is most likely NOT correct? O When comparing two investments, we should consider only their expected returns if their market betas are the same. O If an investment...

-

The numbered items on the left consist of a variety of transactions that occur in a municipality. The lettered items on the right consist of various ways to record the transactions. Select the...

-

The numbered items on the left consist of a variety of transactions that occurred in Jeffersen City's water utility enterprise fund for the year ended June 30, 20X9. Items A, B, C, and D on the right...

-

A hospital radiology department has the following activities: Activity Number Activity Description 1 Repair X-ray equipment 2 Taking X-ray with X-ray...

-

If you were Jennifer, would you have accepted the job?

-

Review the measures retailers use to assess their performance.

-

Describir los factores que los ejecutivos de marketing consideran en la eleccin y administracin de un canal de marketing . OA4

-

Vidi Corporation, a private enterprise, made the following purchases related to its property, plant, and equipment during its fiscal year ended December 31, 2017. The company uses the straight-line...

-

Port Inc. has a 2-stock portfolio with a total value of $100,000. $40,000 is invested in Stock A with a beta of 0.75 and the remainder is invested in Stock B with a beta of 1.30. What is his...

-

The numbered items on the left consist of a variety of transactions that occurred in Jeffersen Citys water utility enterprise fund for the year ended June 30, 20X9. Items A, B, C, and D on the right...

-

Which of the following is reported as a restriction of net position in the net position section of the statement of net position? a. A reservation of the fund balance in the general fund for $10,000...

-

Harvard Company purchases a 90% interest in Bart Company for $720,000 on January 1, 2015. The investment is accounted for under the cost method. At the time of the purchase, a building owned by Bart...

-

Companies that invest heavily in eco-friendly initiatives, such as transitioning to renewable energy sources or implementing carbon offset programs, may initially face increased operational costs....

-

Answer each question individually please. 14-13 What are the advantages and drawbacks of universities using social media to communicate with various stakeholdersstudents, potential students, alumni,...

-

act as a consultant hired by the operations director of the Barry Computer Company provide a financial analysis and comparison to the industry. You will conduct a financial ratio analysis to gain a...

-

Building a sense of community is not just a moral thing to do, but also a pragmatic one. In today's competitive and ever-evolving business environment, the organizations that can attract the most...

-

Watch https://youtu.be/U3MtvvNjUR4 What do you think of Dr. Saint's ideas about barriers to change? What do you think about social learning? Could this tool be used to make real change? How can the...

-

The Banks Corporation sold its credit subsidiary on December 31 of the current year at a gain of $ 237. See below for the corporations income statement before removing the discontinued subsidiary and...

-

Find the intercepts and then graph the line. (a) 2x - 3y = 6 (b) 10 - 5x = 2y

-

Refer to the information in Problem P12-21. Assume that the dollar is the functional currency. In P12-21 Additional Information 1. DaSilva uses FIFO inventory valuation. Purchases were made uniformly...

-

Alamo Inc. purchased 80 percent of the outstanding stock of Western Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (A$) was A$200,000, and...

-

Refer to the information given in Problem P12-23 for Alamo and its subsidiary, Western Ranching. Assume that the Australian dollar (A$) is the functional currency and that Alamo uses the fully...

-

business law A partner may actively compete with the partnership True False

-

A company provided the following data: Selling price per unit $80 Variable cost per unit $45 Total fixed costs $490,000 How many units must be sold to earn a profit of $122,500?

-

Suppose a 10-year, 10%, semiannual coupon bond with a par value of $1,000 is currently selling for $1,365.20, producing a nominal yield to maturity of 7.5%. However, it can be called after 4 years...

Study smarter with the SolutionInn App