Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements is most likely NOT correct? O When comparing two investments, we should consider only their expected returns if their

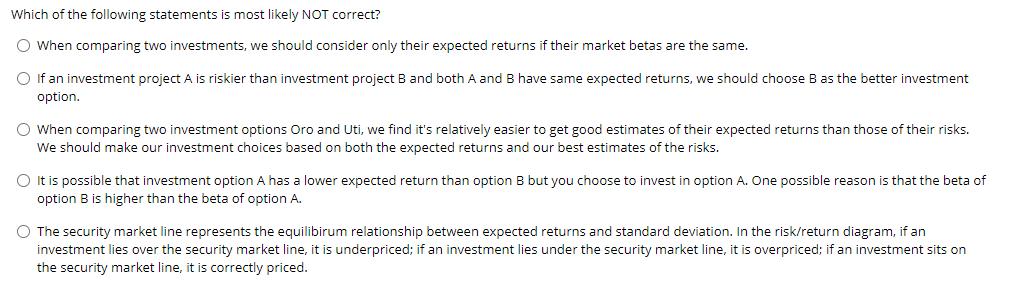

Which of the following statements is most likely NOT correct? O When comparing two investments, we should consider only their expected returns if their market betas are the same. O If an investment project A is riskier than investment project B and both A and B have same expected returns, we should choose B as the better investment option. O When comparing two investment options Oro and Uti, we find it's relatively easier to get good estimates of their expected returns than those of their risks. We should make our investment choices based on both the expected returns and our best estimates of the risks. O It is possible that investment option A has a lower expected return than option B but you choose to invest in option A. One possible reason is that the beta of option B is higher than the beta of option A. O The security market line represents the equilibirum relationship between expected returns and standard deviation. In the risk/return diagram, if an investment lies over the security market line, it is underpriced; if an investment lies under the security market line, it is overpriced; if an investment sits on the security market line, it is correctly priced.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a When comparing two investments we should consider only their expected re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started