The postclosing trial balance of the general fund of Serene Hospital, a not-for-profit entity, on December 31,

Question:

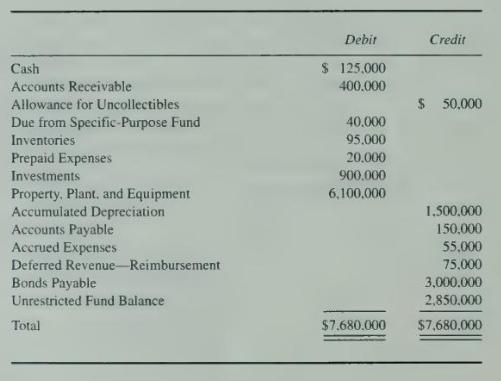

The postclosing trial balance of the general fund of Serene Hospital, a not-for-profit entity, on December 31, 20X1, was as follows:

During \(20 \mathrm{X} 2\) the following transactions occurred:

1. The value of patient services provided was \(\$ 6,160,000\).

2. Contractual adjustments of \(\$ 330,000\) from patients' bills were approved.

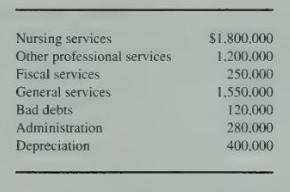

3. Operating expenses totaled \(\$ 5,600,000\), as follows:

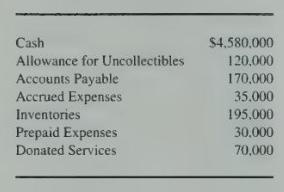

Accounts credited for operating expenses other than depreciation:

4. Received \(\$ 75,000\) cash from specific-purpose fund for partial reimbursement of \(\$ 100,000\) for operating expenditures made in accordance with a restricted gift. The receivable increased by the remaining \(\$ 25,000\) to an ending balance of \(\$ 65,000\).

5. Payments for inventories were \(\$ 176,000\) and for prepaid expenses were \(\$ 24,000\).

6. Received \(\$ 85,000\) income from endowment fund investments.

7. Sold an X-ray machine that had cost \(\$ 30,000\) and had accumulated depreciation of \(\$ 20,000\) for \(\$ 17,000\).

8. Collected \(\$ 5,800,000\) receivables and wrote off \(\$ 132,000\).

9. Acquired investments amounting to \(\$ 60,000\).

10. Income from board-designated investments was \(\$ 72,000\).

11. Paid the beginning balance in Accounts Payable and Accrued Expenses.

12. Deferred Revenue-Reimbursement increased \(\$ 20,000\).

13. Received \(\$ 140,000\) from the plant replacement and expansion fund for use in acquiring fixed assets.

14. Net receipts from the cafeteria and gift shop were \(\$ 63,000\).

\section*{Required}

a. Prepare journal entries to record the transactions for the general fund. Omit explanations.

b. Prepare comparative balance sheets for only the general fund for 20X2 and 20X1.

c. Prepare a statement of operations for the unrestricted, general fund for 20X2.

d. Prepare a statement of cash flows for \(20 \times 2\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King