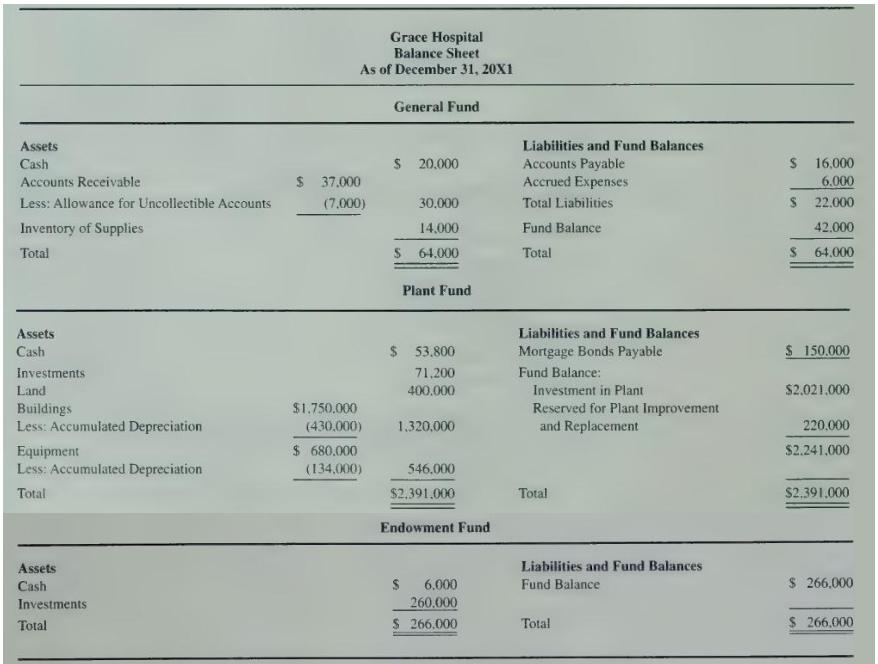

You have been hired to provide accounting assistance to Grace Hospital. The December 31, 20X1, balance sheet

Question:

You have been hired to provide accounting assistance to Grace Hospital. The December 31, 20X1, balance sheet was prepared by a bookkeeper who thought hospitals reported funds as follows:

During \(20 \mathrm{X}\) 2, the following transactions occurred:

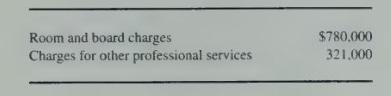

1. Gross charges for patient services, all charged to Accounts Receivable, were as follows:

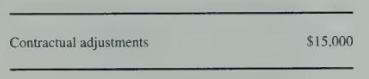

2. Deductions from gross earnings were as follows:

3. The general fund paid \(\$ 18,000\) to retire mortgage bonds payable with an equivalent fair value.

4. During the year, the general fund received general contributions of \(\$ 50,000\) and income from endowment fund investments of \(\$ 6,500\). The general fund has been designated to receive income earned on endowment fund investments.

5. New equipment costing \(\$ 26,000\) was acquired from general fund resources. The plant replacement and expansion fund reimbursed the general fund for the \(\$ 26,000\). An X-ray machine which originally cost \(\$ 24,000\) and which had an undepreciated cost of \(\$ 2,400\) was sold for \(\$ 500\).

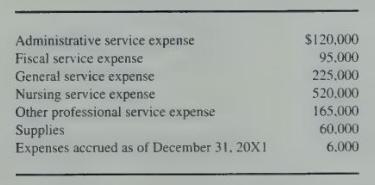

6. Vouchers totaling \(\$ 1,191,000\) were issued for the following items:

7. The provision for uncollectible accounts is increased by \(\$ 30,000\). Collections on accounts receivable totaled \(\$ 985,000\). Accounts written off as uncollectible amounted to \(\$ 11,000\).

8. Cash payments on vouchers payable during the year were \(\$ 825.000\).

9. Supplies of \(\$ 37,000\) were issued to nursing services.

10. On December 31, 20X2, accrued interest income on plant fund investments was \(\$ 800\).

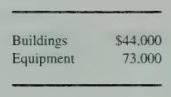

11. Depreciation of buildings and equipment was as follows:

12. On December 31, 20X2, an accrual of \(\$ 6,100\) was made for fiscal service expense on mortgage bonds.

\section*{Required}

a. Restate the balance sheet of Grace Hospital as of December 31, 20X1, to reflect the fact that hospitals do not have an investment in plant funds. (Hint: The \(\$ 53,800\) cash and \(\$ 71.200\) investments belong to temporarily restricted funds for plant replacement, and the other assets reported in the plant fund are properly included as part of unrestricted net assets.)

b. Prepare journal entries to record the transactions for \(20 \times 2\) in the general fund, the plant replacement and expansion fund, and the endowment fund. Assume that the plant fund balances have been transferred to the appropriate funds as indicated in part \(a\) of this problem. Omit explanations.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King