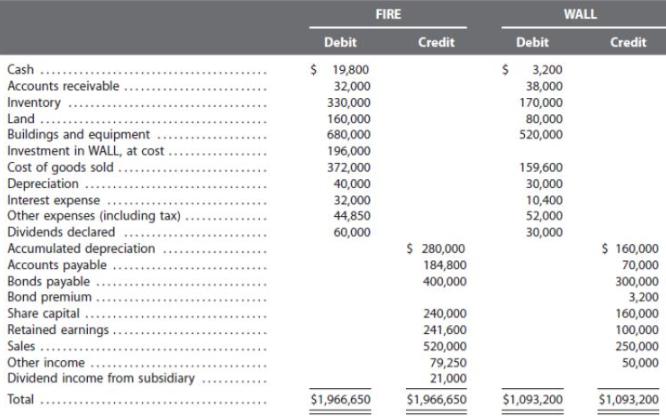

The trial balances for FIRE and WALL as of 31 December 20x3 are as follows: Additional information:

Question:

The trial balances for FIRE and WALL as of 31 December 20x3 are as follows:

Additional information:

(a) On 1 January 20x2, FIRE purchased 70% of WALL’s ordinary shares. At the date of acquisition, share capital of WALL was \($160\),000 and retained earnings were \($40\),000.

(i) The excess of the acquisition price over the underlying book value was assigned to:

Buildings that had a fair value of \($40\),000 greater than book value and remaining useful life of ten years from 1 January 20x2; and Goodwill. Goodwill impairment amounting to 20% of its original cost was recognized in 20x2.

(ii) Fair value of WALL as at acquisition date was \($280\),000. Non-controlling interests as at 1 January 20x2 had a proportionate share in the fair value of WALL as at that date.

(b) During 20x2, the following transactions arose:

(i) WALL purchased inventory for \($64\),000 and sold it to FIRE for \($96\),000. FIRE resold \($54\),000 of the inventory during 20x3, while the balance of \($42\),000 remained unsold as at 31 December 20x3.

(ii) FIRE sold the building that it originally purchased for \($40\),000 to WALL for \($64\),000. Accumulated depreciation at the date of sale was \($8\),000. Estimated useful life at date of original purchase was ten years and at the date of resale was eight years. WALL had recognized a full year’s depreciation on the building in 20x2.

(c) During 20x3, FIRE sold inventory purchased for \($120\),000 to WALL for \($180\),000. WALL resold 40% of the inventory during 20x3.

(d) Tax rate was 20%. Recognize tax effects where appropriate.

Required:

1. Show all consolidation adjustment and elimination entries for the year ended 31 December 20x3.

2. Perform an analytical check on the non-controlling interests in WALL as at 31 December 20x3.

3. Prepare the consolidation worksheets for FIRE and WALL for the year ended 31 December 20x3.

4. Determine the following amounts for 20x3 analytically and compare with the amounts in your consolidation worksheets in 3:

(a) Consolidated cost of sales

(b) Consolidated depreciation expense

(c) Consolidated inventory balance

(d) Consolidated carrying amount of buildings and equipment

(e) Consolidated retained earnings

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah