Tower Inc. advises you that it is facing bankruptcy proceedings. As the company's CPA, you are aware

Question:

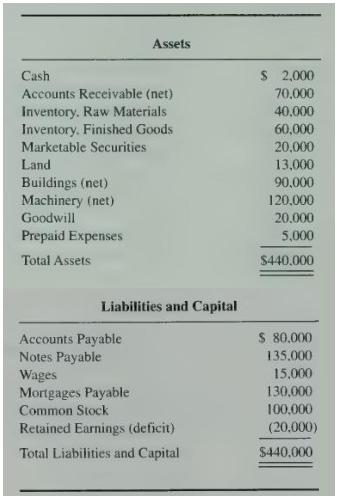

Tower Inc. advises you that it is facing bankruptcy proceedings. As the company's CPA, you are aware of its condition. The balance sheet of Tower Inc. on December 31, 20X1, and supplementary data are presented here.

1. Cash includes a \(\$ 500\) travel advance that has been expended.

2. Accounts receivable of \(\$ 40,000\) have been pledged in support of bank loans of \(\$ 30,000\). Credit balances of \(\$ 5,000\) are netted in the accounts receivable total.

3. Marketable securities consist of government bonds costing \(\$ 10,000\) and 500 shares of Dawson Company stock. The market value of the bonds is \(\$ 10,000\), and the stock is \(\$ 18\) per share. The bonds have \(\$ 200\) of accrued interest due. The securities are collateral for a \(\$ 20,000\) bank loan.

4. Appraised value of raw materials is \(\$ 30,000\) and of finished goods is \(\$ 50,000\). For an additional cost of \(\$ 10,000\), the raw materials could realize \(\$ 70,000\) as finished goods.

5. The appraised value of fixed assets is \(\$ 25,000\) for land, \(\$ 110,000\) for buildings, and \(\$ 75,000\) for machinery.

6. Prepaid expenses will be exhausted during the liquidation period.

7. Accounts payable include \(\$ 15,000\) of withheld payroll taxes and \(\$ 6,000\) owed to creditors who have been reassured by the president of Tower that they would be paid. There are unrecorded employer's payroll taxes in the amount of \(\$ 500\).

8. Wages payable are not subject to any limitations under bankruptcy laws.

9. Mortgages payable consist of \(\$ 100,000\) on land and buildings and \(\$ 30,000\) for a chattel mortgage on machinery. Total unrecorded accrued interest for these mortgages amounts to \(\$ 2,400\).

10. Estimated legal fees and expenses in connection with the liquidation are \(\$ 10,000\).

11. The probable judgment on a pending damage suit is \(\$ 50,000\).

12. You have not rendered an invoice for \(\$ 5.000\) for last year's audit, and you estimate a \(\$ 1,000\) fee for liquidation work.

\section*{Required}

a. Prepare a statement of affairs. (The book value column should reflect adjustments that properly should have been made as of December 31, 20X1, in the normal course of business.)

b. Compute the estimated settlement per dollar of unsecured liabilities.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King