Tyler Manufacturing purchased 60 percent of the ownership of Brown Corporation stock on January 1, 20X1, at

Question:

Tyler Manufacturing purchased 60 percent of the ownership of Brown Corporation stock on January 1, 20X1, at underlying book value. Tyler also purchased \(\$ 50,000\) of Brown Corporation bonds at par value on December 31, 20X3. The bonds were sold by Brown Corporation on January 1,20X1, at 120 and have a stated interest rate of 12 percent. Interest is paid semiannually on June 30 and December 31 .

On December 31, 20X1, Brown sold to Tyler for \(\$ 30,000\) a building with a remaining life of 15 years. The building was purchased by Brown 10 years earlier for \(\$ 40,000\) and is being charged to operating expense on a 25 -year expected life.

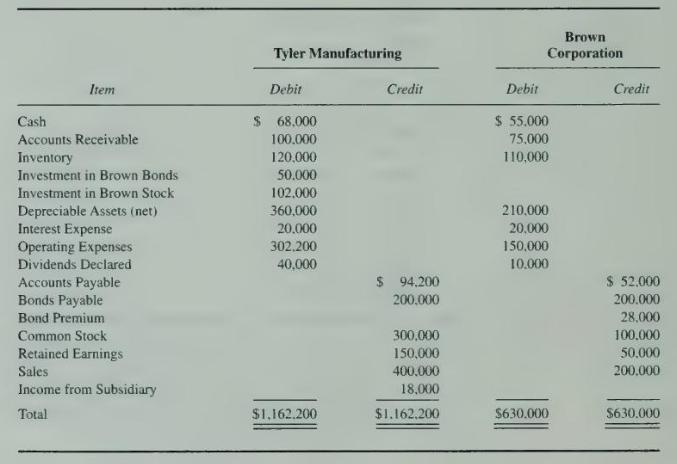

Trial balances for the two companies on December 31, 20X3, are as follows:

\section*{Required}

a. Prepare a consolidation workpaper for 20X3, in good form.

b. Prepare a consolidated balance sheet, income statement, and statement of changes in retained earnings for \(20 \mathrm{X} 3\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King