Suppose that a portfolio consists of three US stocks, namely, Alcoa, American Express, and Abbott Laboratories. The

Question:

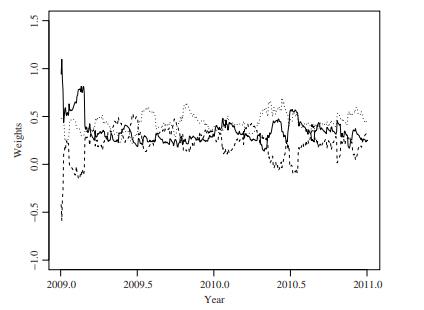

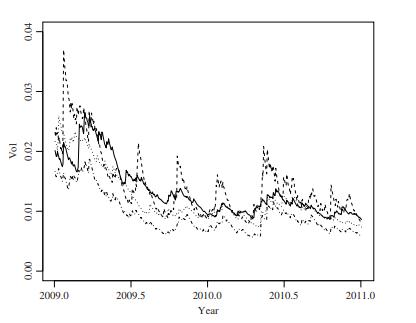

Suppose that a portfolio consists of three US stocks, namely, Alcoa, American Express, and Abbott Laboratories. The daily simple returns are available from the file d-a2a-0110.txt. Use GARCH models to obtain the conditional covariance matrices of the stocks for the period from December 29, 2008 to December 31, 2010. Obtain the weights and the resulting volatility of the minimum variance portfolio for the period. Plot the weights and the volatilities similar to those in Figures 5.7 and 5.8.

Figure 5.7:

Figure 5.8:

Step by Step Answer:

Related Book For

An Introduction To Analysis Of Financial Data With R

ISBN: 9780470890813

1st Edition

Authors: Ruey S Tsay

Question Posted: