On May 21, 2020, an investor owns 100 Apple shares. As indicated in Table 1.3, the share

Question:

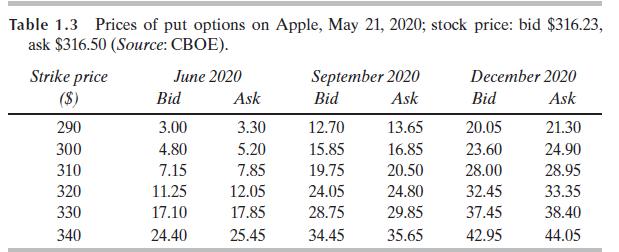

On May 21, 2020, an investor owns 100 Apple shares. As indicated in Table 1.3, the share price is about \($316\) and a December put option with a strike price of \($290\) costs \($21.30\).

The investor is comparing two alternatives to limit downside risk. The first involves buying one December put option contract with a strike price of \($290\). The second involves instructing a broker to sell the 100 shares as soon as Apple’s price reaches \($290\). Discuss the advantages and disadvantages of the two strategies.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: