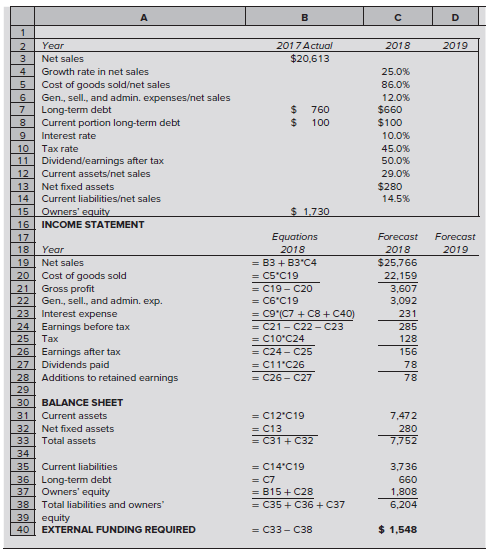

Table 3.5 presents a computer spreadsheet for estimating R&E Supplies' external financing required for 2018. The text

Question:

Table 3.5 presents a computer spreadsheet for estimating R&E Supplies' external financing required for 2018. The text mentions that with modifications to the equations for equity and net sales, the forecast can easily be extended through 2019. Write the modified equations for equity and net sales.

Table 3.5

Why Are Lenders So Conservative?

Why Are Lenders So Conservative?

Some would answer, “Too much Republican in-breeding,” but there is another possibility: low returns. Simply put, if expected loan returns are low, lenders cannot accept high risks.

Let us look at the income statement of a representative bank lending operation with, say, 100 $1 million loans, each paying 10 percent interest:

($ thousands)

Interest income (10% × 100 × $1 million) ....................... $10,000

Interest expense ................................................................ 7,000

Gross income ...................................................................... 3,000

Operating expenses ........................................................... 1,000

Income before tax .............................................................. 2,000

Tax at 40% rate ................................................................... 800

Income after tax $ .............................................................. 1,200

The $7 million interest expense represents a 7 percent return the bank must promise depositors and investors to raise the $100 million lent. (In bank jargon, these loans offer a 3 percent lending margin, or spread.) Operating expenses include costs of the downtown office towers, the art collection, wages, and so on.

These numbers imply a minuscule return on assets of 1.2 percent ($1.2 million/[100 × $1 million]). We know from the levers of performance that to generate any kind of reasonable return on equity, banks must pile on the financial leverage. Indeed, to generate a 12 percent ROE, our bank needs a 10-to-1assets-to-equity ratio or, equivalently, $9 in liabilities for every $1 in equity.

Worse yet, our profit figures are too optimistic because they ignore the reality that not all loans are repaid. Banks typically are able to recover only about 40 percent of the principal value of defaulted loans, implying a loss of $600,000 on a $1 million default. Ignoring tax losses on defaulted loans, this means that if only two of the bank’s 100 loans go bad annually, the bank’s $1.2 million in expected profits will evaporate. Stated differently, a loan officer must be almost certain that each loan will be repaid just to break even. (Alternatively, the officer must be almost certain of being promoted out of lending before the loans start to go bad.) So why are lenders conservative? Because the aggressive ones have long since gone bankrupt

Step by Step Answer: