Answered step by step

Verified Expert Solution

Question

1 Approved Answer

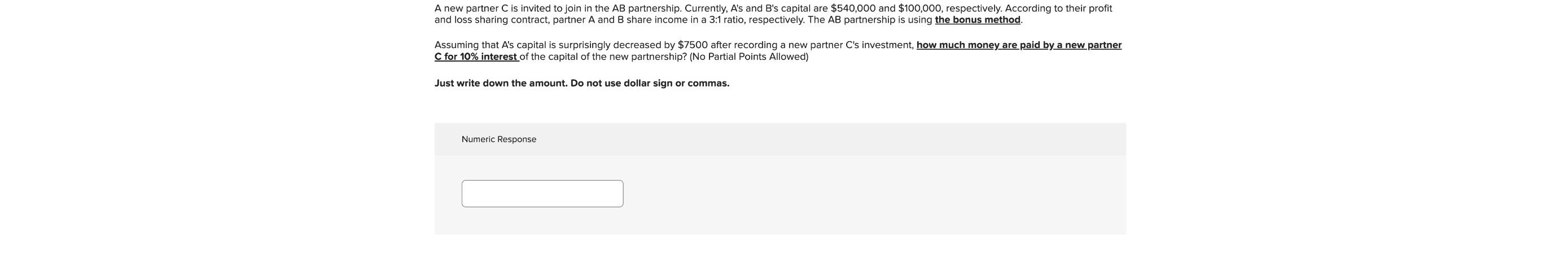

A new partner C is invited to join in the AB partnership. Currently, A's and B's capital are $540,000 and $100,000, respectively. According to

A new partner C is invited to join in the AB partnership. Currently, A's and B's capital are $540,000 and $100,000, respectively. According to their profit and loss sharing contract, partner A and B share income in a 3:1 ratio, respectively. The AB partnership is using the bonus method. Assuming that A's capital is surprisingly decreased by $7500 after recording a new partner C's investment, how much money are paid by a new partner C for 10% interest of the capital of the new partnership? (No Partial Points Allowed) Just write down the amount. Do not use dollar sign or commas. Numeric Response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Partner As decreased capital 540000 7500 532500 Partner Bs capi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started