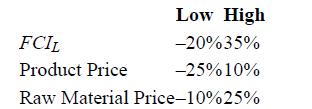

Perform a Monte-Carlo simulation on Example 10.1 for the following conditions. Show that the variation in the

Question:

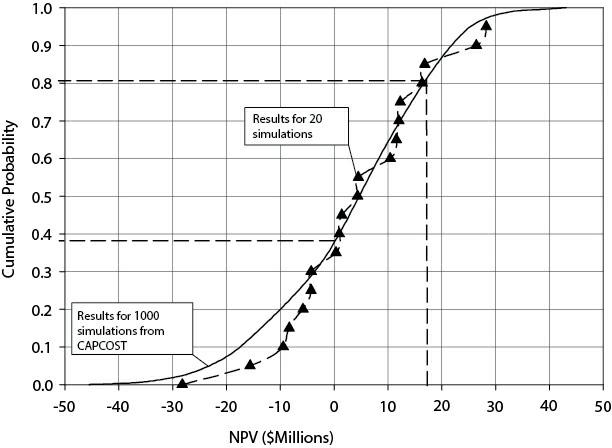

Perform a Monte-Carlo simulation on Example 10.1 for the following conditions. Show that the variation in the NPV is the same as shown in Figure 10.15. To which variable is the NPV more sensitive?

Because the Monte-Carlo method is based on the generation of random numbers, no two simulations will be exactly the same. Therefore, you may see some small differences between your results and those shown in Figure 10.15.

Example 10.1

The evaluation of a project requiring a large capital investment has yielded an NPV (net present value) of $20 × 106. If the internal hurdle rate for this project was set at 10% p.a., will the DCFROR (discounted cash flow rate of return) be greater or less than 10%? Explain.

Step by Step Answer:

Analysis Synthesis And Design Of Chemical Processes

ISBN: 9780134177403

5th Edition

Authors: Richard Turton, Joseph Shaeiwitz, Debangsu Bhattacharyya, Wallace Whiting