Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. This question asks you to think about narrow bracketing and risky choice using actual reference-dependent utility functions from earlier in the class. Suppose

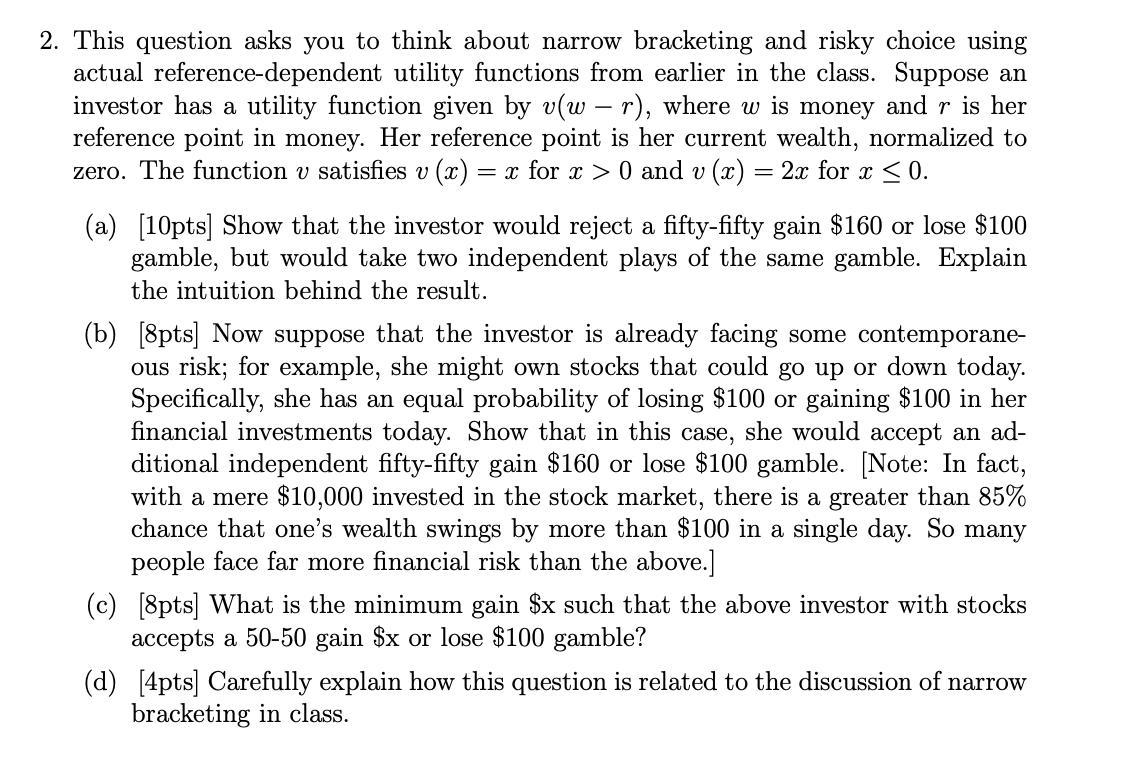

2. This question asks you to think about narrow bracketing and risky choice using actual reference-dependent utility functions from earlier in the class. Suppose an investor has a utility function given by v(w r), where w is money and r is her reference point in money. Her reference point is her current wealth, normalized to zero. The function v satisfies v (x) = x for x > 0 and v(x) = 2x for x 0. (a) [10pts] Show that the investor would reject a fifty-fifty gain $160 or lose $100 gamble, but would take two independent plays of the same gamble. Explain the intuition behind the result. (b) [8pts] Now suppose that the investor is already facing some contemporane- ous risk; for example, she might own stocks that could go up or down today. Specifically, she has an equal probability of losing $100 or gaining $100 in her financial investments today. Show that in this case, she would accept an ad- ditional independent fifty-fifty gain $160 or lose $100 gamble. [Note: In fact, with a mere $10,000 invested in the stock market, there is a greater than 85% chance that one's wealth swings by more than $100 in a single day. So many people face far more financial risk than the above.] (c) [8pts] What is the minimum gain $x such that the above investor with stocks accepts a 50-50 gain $x or lose $100 gamble? (d) [4pts] Carefully explain how this question is related to the discussion of narrow bracketing in class.

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a The investors utility function implies that she is riskaverse for gains vx x for x 0 but is riskseeking for losses vx 2x for x 0 Thus the investor w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started