You are reviewing the audit files of Monty Ltd with a view to finalising the audit. From

Question:

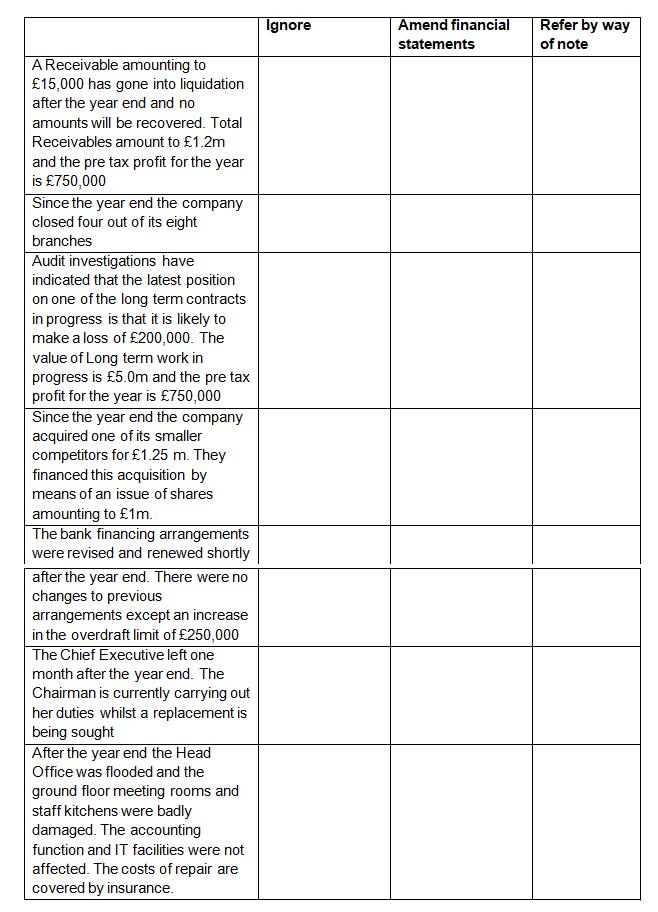

You are reviewing the audit files of Monty Ltd with a view to finalising the audit. From your review of the files you identify the following factors. Identify whether or not they can be

a) Ignored

b) Whether the financial statements might have to be amended

c) Whether or not the financial statements should include a reference by way of a note without any adjustment to the figures

In the table below tick the response you feel is the most appropriate

Transcribed Image Text:

A Receivable amounting to £15,000 has gone into liquidation after the year end and no amounts will be recovered. Total Receivables amount to £1.2m and the pre tax profit for the year is £750,000 Since the year end the company closed four out of its eight branches Audit investigations have indicated that the latest position on one of the long term contracts in progress is that it is likely to make a loss of £200,000. The value of Long term work in progress is £5.0m and the pre tax profit for the year is £750,000 Since the year end the company acquired one of its smaller competitors for £1.25 m. They financed this acquisition by means of an issue of shares amounting to £1m. The bank financing arrangements were revised and renewed shortly after the year end. There were no changes to previous arrangements except an increase in the overdraft limit of £250,000 The Chief Executive left one month after the year end. The Chairman is currently carrying out her duties whilst a replacement is being sought After the year end the Head Office was flooded and the ground floor meeting rooms and staff kitchens were badly damaged. The accounting function and IT facilities were not affected. The costs of repair are covered by insurance. Ignore Amend financial statements Refer by way of note

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

A Receivable amounting to 15000 has gone into liquidation after the year end and no amounts will be ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Prosci's change management methodology is developed based on research with over 3,400 participants over the last twenty years. What is unique about the methodology is that it comes from real project...

-

You are the Engagement Quality Control Reviewer in the firm Hartley & King (HK) LLP and you are responsible for the independent review of all audits. It is March 1st, 2017, you are reviewing the...

-

Use a calculator to express each number in Problems 39 and 40 as a decimal to the capacity of your calculator. Observe the repeating decimal representation of the rational numbers and the non...

-

Consider a portfolio that offers an expected rate of return of 12% and a standard deviation of 18%. T-bills offer a risk-free 7% rate of return. What is the maximum level of risk aversion for which...

-

Briefly describe the coverage provided under the Medical Payments coverage under Section II of the Homeowners Policy. To whom does the coverage apply? To whom does it not apply?

-

Spot price of natural gas. The table shown in the next column lists the spot price of natural gas (in dollars per million Btu) between 2000 and 2020. a. Using 2000 as the base period, calculate and...

-

Technical Textile agreed by written contract to manufacture and sell 20,000 pounds of yarn to Jagger Brothers at a price of $2.15 per pound. After Technical had manufactured, delivered, and been paid...

-

Problem 20-02A a-c For the year ended December 31, 2020, the job cost sheets of Blossom Company contained the following data. Job Number Direct Materials Direct Labor Manufacturing Overhead Total...

-

On December 31, Y3, Aylmer Industries Inc. purchased 85% of the outstanding shares of Belmont Inc. The purchase price is indicated on the excel file. The entry has been recorded on the books of...

-

An external auditor is required to carry out a final review to ensure their conclusions are supported by sufficient reliable evidence Select whether each of the statements below is true or false in...

-

To which of the following stakeholders do the auditors of Tesco plc have a legal as opposed to a moral responsibility a. The bank b. The employees c. HM Revenue and Customs d. People intending to buy...

-

In the country where you live, what aspects of the government resemble capitalism? What aspects resemble socialism? Are there aspects of other systems of government?

-

List and describe three common interview mistakes which compromise the quality of the selection process.

-

Player I chooses a positive integer x > 0 and player II chooses a positive integer y > 0. The player with the lower number pays a dollar to the player with the higher number unless the higher number...

-

1. Distinguish between risk management and risk transfer. As the manager of XYZ FBO, what measures would you put in place to ensure risk reduction?

-

Devlop a sumary of your understanding of Learning and Retention. In the sumary, think about how you see Learning and Retention fitting into the entire study of Organizational Behavior. How does the...

-

Emani, Peters and Desai et al (2018) "conducted a cross-sectional survey of adopters and non-adopters of the portal...the survey consisted of perceived attributes from the DOI theory,...

-

How should the tax professional advise a client whose charitable contributions are double that of the U.S. norm for his or her income level?

-

Prepare a stock card using the following information A company is registered for GST which it pays quarterly, assume GST was last paid on the 30th of June 2019. It uses weighted average cost...

-

Sheek Clothing plc is a retailer with 200 branches throughout the UK. Most of the branches are small. The inventory is a very significant item in the financial statements. Inventory is counted...

-

Where is a 100 per cent check likely to be applied?

-

Hoopoe plc is an old established large food processing company mainly buying poultry from local farmers, freezing them and selling them to retailers on credit terms. Assets employed total 6m, revenue...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App