On December 31, Y3, Aylmer Industries Inc. purchased 85% of the outstanding shares of Belmont Inc. The purchase price is indicated on the excel

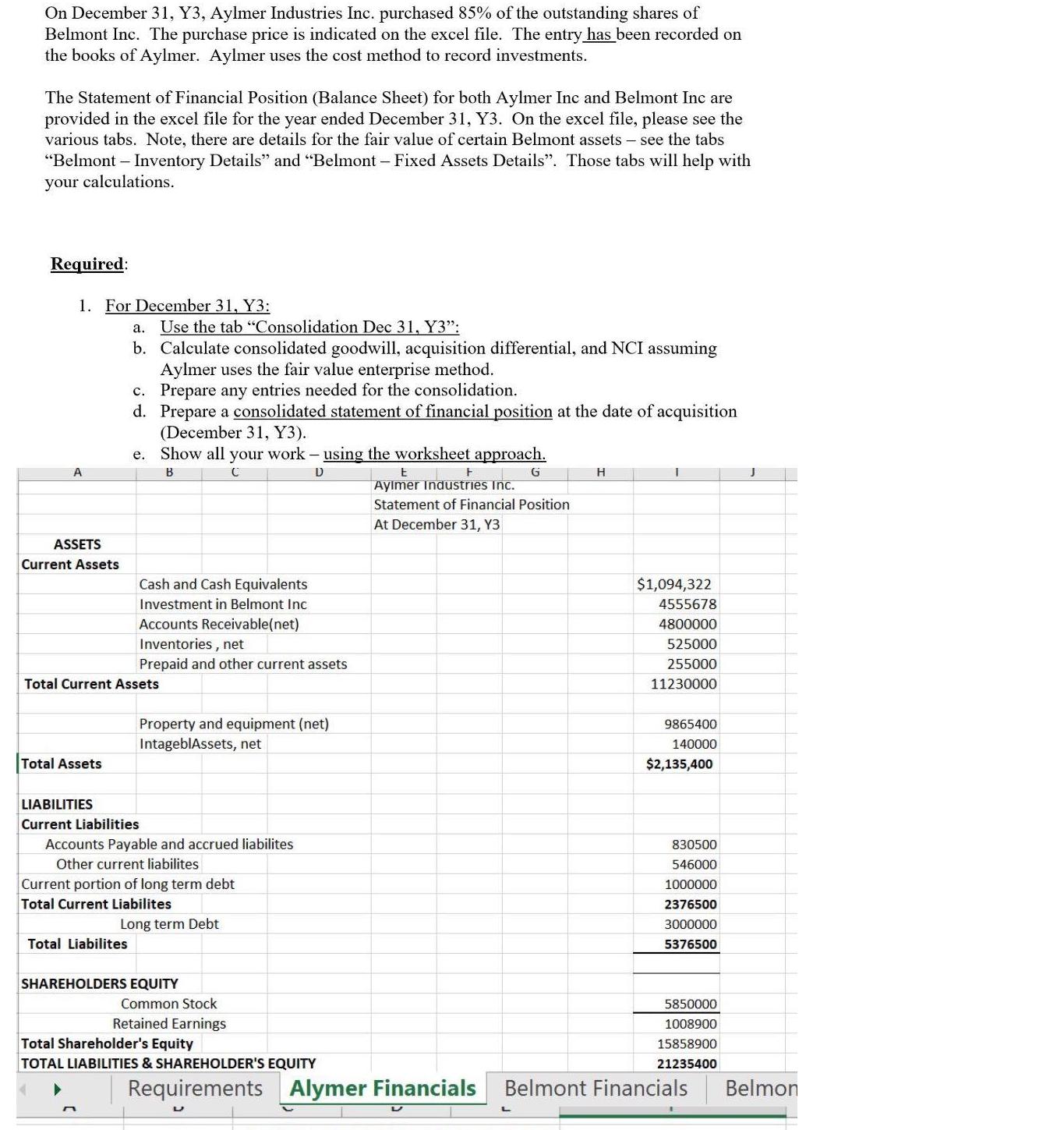

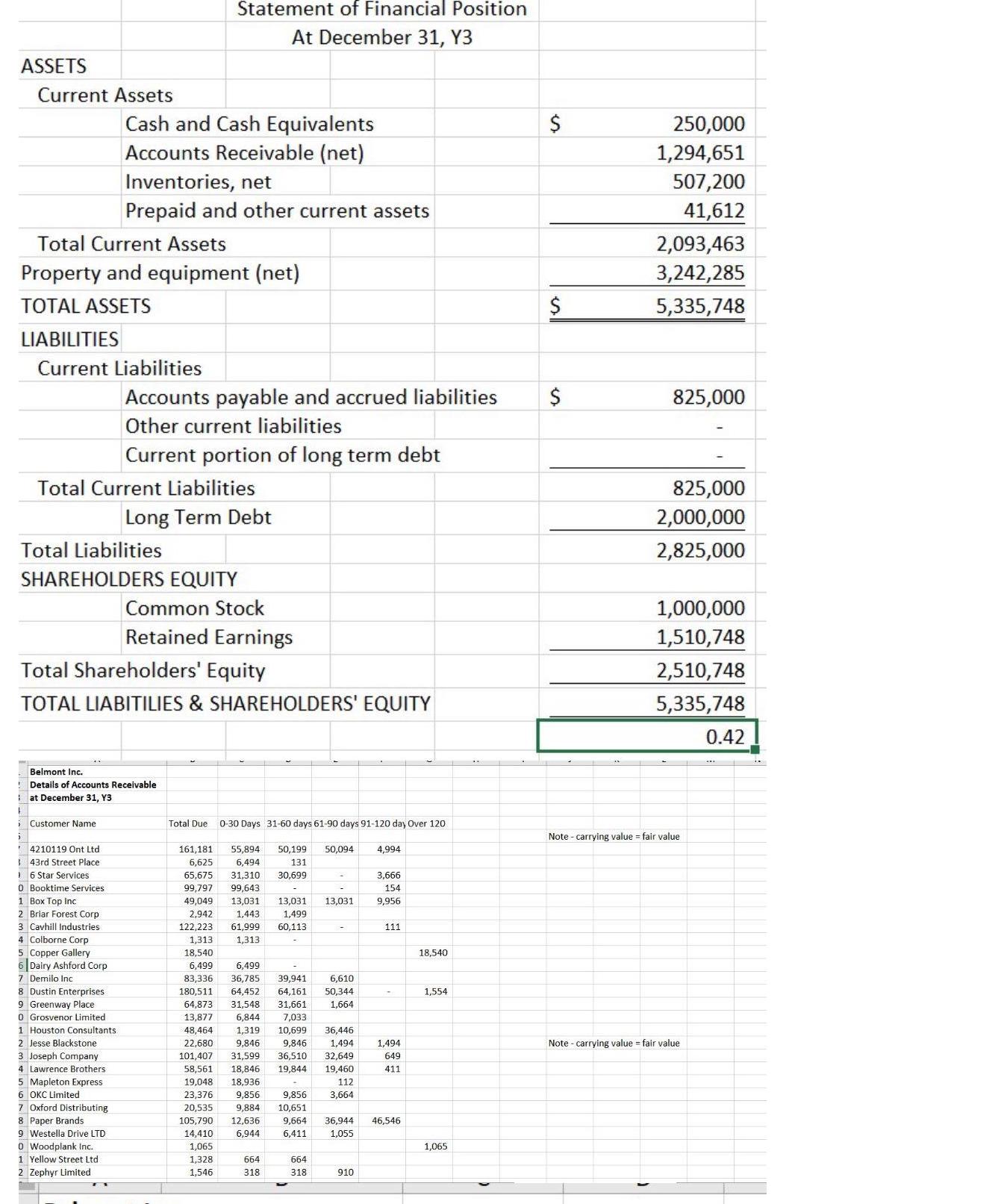

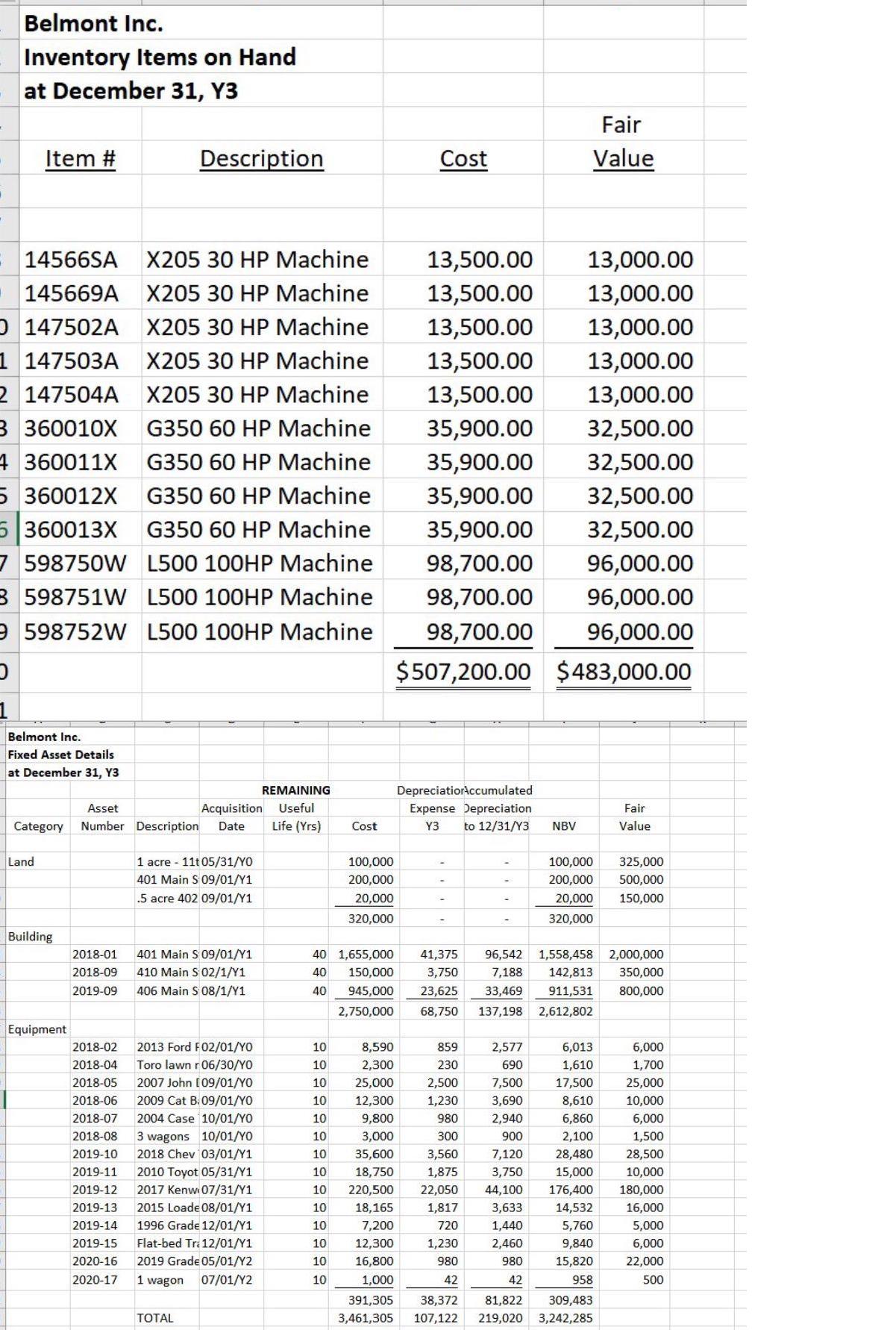

On December 31, Y3, Aylmer Industries Inc. purchased 85% of the outstanding shares of Belmont Inc. The purchase price is indicated on the excel file. The entry has been recorded on the books of Aylmer. Aylmer uses the cost method to record investments. The Statement of Financial Position (Balance Sheet) for both Aylmer Inc and Belmont Inc are provided in the excel file for the year ended December 31, Y3. On the excel file, please see the various tabs. Note, there are details for the fair value of certain Belmont assets - see the tabs "Belmont - Inventory Details" and "Belmont - Fixed Assets Details". Those tabs will help with your calculations. Required: 1. For December 31, Y3: A ASSETS Current Assets Total Assets a. Use the tab "Consolidation Dec 31, Y3": b. Calculate consolidated goodwill, acquisition differential, and NCI assuming Aylmer uses the fair value enterprise method. c. Prepare any entries needed for the consolidation. d. Prepare a consolidated statement of financial position at the date of acquisition (December 31, Y3). e. Show all your work - using the worksheet approach. B D Total Current Assets Cash and Cash Equivalents Investment in Belmont Inc Accounts Receivable(net) Inventories, net Prepaid and other current assets Property and equipment (net) IntageblAssets, net LIABILITIES Current Liabilities Total Liabilites Accounts Payable and accrued liabilites Other current liabilites Current portion of long term debt Total Current Liabilites Long term Debt SHAREHOLDERS EQUITY Common Stock Retained Earnings Total Shareholder's Equity TOTAL LIABILITIES & SHAREHOLDER'S EQUITY E F Aylmer Industries Inc. Statement of Financial Position At December 31, Y3 G H $1,094,322 4555678 4800000 525000 255000 11230000 9865400 140000 $2,135,400 830500 546000 1000000 2376500 3000000 5376500 5850000 1008900 15858900 21235400 Requirements Alymer Financials Belmont Financials Belmon ASSETS Current Assets LIABILITIES Total Current Assets Property and equipment (net) TOTAL ASSETS Current Liabilities Total Current Liabilities Long Term Debt Customer Name Cash and Cash Equivalents Total Liabilities SHAREHOLDERS EQUITY 4210119 Ont Ltd 43rd Street Place Statement of Financial Position At December 31, Y3 Accounts Receivable (net) Inventories, net Prepaid and other current assets 6 Star Services 0 Booktime Services 1 Box Top Inc 2 Briar Forest Corp 3 Cavhill Industries 4 Colborne Corp 5 Copper Gallery 6 Dairy Ashford Corp 7 Demilo Inc 8 Dustin Enterprises 9 Greenway Place 0 Grosvenor Limited 1 Houston Consultants. 2 Jesse Blackstone 3 Joseph Company 4 Lawrence Brothers. Total Shareholders' Equity TOTAL LIABITILIES & SHAREHOLDERS' EQUITY Belmont Inc. Details of Accounts Receivable at December 31, Y3 5 Mapleton Express 6 OKC Limited 7 Oxford Distributing 8 Paper Brands 9 Westella Drive LTD Accounts payable and accrued liabilities Other current liabilities Current portion of long term debt 0 Woodplank Inc. 1 Yellow Street Ltd. 2 Zephyr Limited Common Stock Retained Earnings Total Due 0-30 Days 31-60 days 61-90 days 91-120 day Over 120 161,181 55,894 50,199 50,094 6,625 6,494 131 31,310 30,699 65,675 99,797 99,643 49,049 13,031 13,031 13,031 2,942 1,443 1,499 61,999 60,113 1,313 122,223 1,313 18,540 6,499 6,499 83,336. 36,785 39,941 6,610 180,511 64,452 64,161 50,344 64,873 31,548 31,661 1,664 13,877 6,844 48,464 36,446 7,033 1,319 10,699 9,846 9,846 1,494 31,599 36,510 32,649 22,680 101,407 58,561 18,846. 19,844 19,460 19,048 18,936 23,376 20,535 105,790 14,410 1,065 1,328 1,546. 9,856 9.856 9,884 10,651 12,636 6.944 664 318 0 112 3,664 664 318 4,994 910 3,666 154 9,956 9,664 36,944 46,546 6,411 1,055 111 1,494 649 411 18,540 1,554 1,065 $ $ $ 250,000 1,294,651 507,200 41,612 2,093,463 3,242,285 5,335,748 825,000 825,000 2,000,000 2,825,000 1,000,000 1,510,748 2,510,748 5,335,748 0.42 Note-carrying value = fair value Note - carrying value = fair value - . 7 Belmont Inc. Inventory Items on Hand at December 31, Y3 O 1 Item # = 14566SA 145669A O 147502A 1 147503A 2 147504A 3 360010X 4 360011X 5 360012X 6 360013X 7 598750W L500 100HP Machine 8 598751W L500 100HP Machine 9598752W L500 100HP Machine Belmont Inc. Fixed Asset Details at December 31, Y3 Land REMAINING Asset Acquisition Useful Category Number Description Date Life (Yrs) Building Equipment Description X205 30 HP Machine X205 30 HP Machine X205 30 HP Machine X205 30 HP Machine X205 30 HP Machine G350 60 HP Machine G350 60 HP Machine G350 60 HP Machine G350 60 HP Machine 2018-01 2018-09 2019-09 1 acre 11t 05/31/YO 401 Main S 09/01/Y1 .5 acre 402 09/01/Y1 401 Main S 09/01/Y1 410 Main S 02/1/Y1 406 Main S 08/1/Y1 2013 Ford F02/01/YO 2018-02 2018-04 3 wagons 10/01/YO Toro lawn r06/30/YO 2018-05 2007 John [09/01/YO 2018-06 2009 Cat B. 09/01/YO 2018-07 2004 Case 10/01/YO 2018-08 2019-10 2018 Chev 03/01/Y1 2019-11 2010 Toyot 05/31/Y1 2019-12 2017 Kenw 07/31/Y1 2019-13 2015 Loade 08/01/Y1 2019-14 1996 Grade 12/01/Y1 2019-15 Flat-bed Tra 12/01/Y1 2020-16 2019 Grade 05/01/Y2 2020-17 1 wagon 07/01/Y2 TOTAL Cost 100,000 200,000 20,000 320,000 Cost DepreciatiorAccumulated 13,500.00 13,500.00 13,500.00 13,500.00 13,500.00 35,900.00 32,500.00 35,900.00 32,500.00 35,900.00 32,500.00 35,900.00 32,500.00 98,700.00 96,000.00 98,700.00 96,000.00 98,700.00 96,000.00 $507,200.00 $483,000.00 Expense Depreciation Y3 to 12/31/Y3 NBV 859 230 2,500 1,230 980 300 Fair Value 13,000.00 13,000.00 13,000.00 13,000.00 13,000.00 8,590 2,300 25,000 12,300 10 10 10 10 10 9,800 10 3,000 10 35,600 10 18,750 10 220,500 10 18,165 10 7,200 12,300 10 10 10 16,800 1,000 391,305 38,372 81,822 3,461,305 107,122 3,560 1,875 22,050 1,817 720 1,230 980 42 100,000 200,000 20,000 320,000 350,000 40 1,655,000 41,375 96,542 1,558,458 2,000,000 40 150,000 3,750 7,188 142,813 40 945,000 23,625 33,469 911,531 2,750,000 68,750 137,198 800,000 2,612,802 2,577 690 7,500 3,690 2,940 900 7,120 3,750 44,100 176,400 3,633 14,532 1,440 5,760 2,460 9,840 980 15,820 42 958 6,013 1,610 17,500 8,610 6,860 2,100 28,480 15,000 Fair Value 309,483 219,020 3,242,285 325,000 500,000 150,000 6,000 1,700 25,000 10,000 6,000 1,500 28,500 10,000 180,000 16,000 5,000 6,000 22,000 500

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To solve the consolidation problem follow these steps Step 1 Calculate Goodwill and NonControlling Interest NCI 11 Acquisition Cost and Fair Value of ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started