Kent County Grain and Milling Company decided to stimulate the sale of its flour by including a

Question:

Kent County Grain and Milling Company decided to stimulate the sale of its flour by including a coupon, redeemable for fifty cents ( \(50 q\) ), in every 25 - and 50 -pound sack of flour produced subsequent to October 1, 19X0. The company contemplates that 150,000 coupons will be in the hands of customers before completion of the promotional campaign on March 31, 19X1.

On commencing your year-end work on January 10, 19X1 for the calendar year ending December 31, 19X0, the controller of Kent County Grain and Milling Company requested that you review the accounting records and the internal accounting control applicable to the flour coupons.

In your review of the accounting records and the system of internal accounting controls, you learned the following:

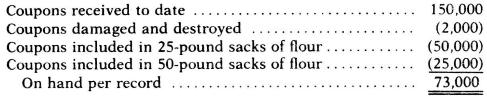

1. A perpetual record of coupons received from the printer is entered from a copy of the receiving ticket, damaged coupons are reported orally by a line foreman, and coupons used are entered from a copy of the production report of sacks of flour packed. A summary of the perpetual record as of December \(31,19 \times 0\) is as follows:

2. Unused coupons are kept in a storeroom with stationery and supplies and are readily accessible. No count of coupons within a package is made as they are received from the printers; however, the number of packages times the indicated amount in each package is recorded on a receiving ticket which is later agreed, in the office, with a copy of the vendor's invoice.

3. Coupons are sometimes damaged by the machinery which mechanically inserts them in the sacks. The production superintendent said that he thought that the line foreman destroyed these coupons. As previously mentioned, the number of damaged coupons are reported to the production superintendent orally each day by the foreman.

4. The line foreman takes a quantity of unused coupons from the storeroom each day based on scheduled production for that day.

5. Correspondence containing coupons mailed to the company for redemption is first opened in the mail department. The coupons are then sent to the cashier department where they are redeemed in cash out of a fund especially set up for that purpose. The cashier places a 50 cent piece in a self-addressed envelope, seals the envelope, and returns it to the mail department for ultimate disposition. The cashier stamps the coupon paid with the date of payment.

6. Once each week the cashier's coupon fund is reimbursed in the same manner as any other imprest fund.

7. Complaints from customers not receiving their 50 cent pieces are sent to the cashier for disposition.

You also learned that a physical inventory of unused coupons was taken on December 31, 19X0. It was found that 71,250 coupons were on hand. As of December \(31,19 \times 0\), flour containing 50,000 coupons had been sold to the company's retail outlets. In addition, by December 31, 19X0, 37,500 coupons had been redeemed and paid, and it was estimated that only 50 percent of the remaining coupons outstanding at that time would be redeemed.

Required:

a. Prepare a memorandum to the controller as to weaknesses in his present control procedures in regard to handling redeemable coupons and your recommendations for improvement.

b. Prepare a journal entry setting up the company's liability for unredeemed coupons as at December 31, 19X0. Show your method of computing the liability

c. Identify the weaknesses, if any, you believe are material. Explain fully.

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler