Question: The internal control questionnaire in Figure (8-3) includes the following questions: 1. Are prelists prepared for mail receipts? 2. Are cash registers used for over-the-counter

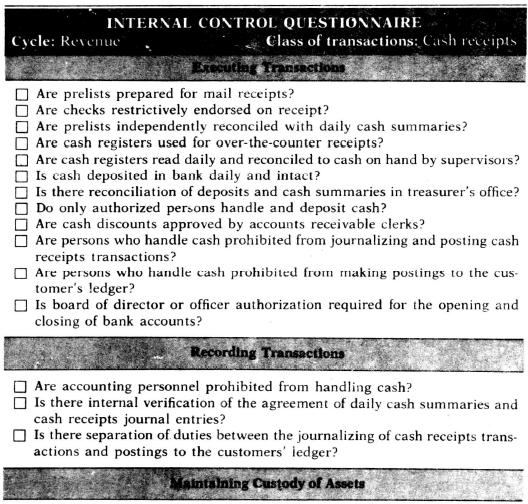

The internal control questionnaire in Figure \(8-3\) includes the following questions:

1. Are prelists prepared for mail receipts?

2. Are cash registers used for over-the-counter receipts?

3. Are cash registers read daily and reconciled to cash on hand by supervisors?

4. Is there reconciliation of deposits and cash summaries in treasurer's office?

5. Are cash discounts approved by accounts receivable clerks?

6. Is there internal verification of the agreement of daily cash summaries and cash receipts journal entries?

7. Is there separation of duties between the journalizing of cash receipts transactions and postings to the customers' ledger?

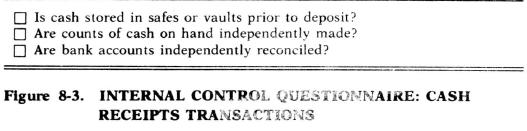

8. Is cash stored in safes or vaults prior to deposit?

9. Are bank accounts independently reconciled?

Required:

a. Identify the internal control objective to which each question relates (i.e., executing, recording, or custody).

b. Identify the function and specific internal accounting control objective to which the question pertains.

c. Indicate the internal accounting control principle that is involved.

d. Identify an error or irregularity that may result from a "No" answer to each question.

Figure 8-3

INTERNAL CONTROL QUESTIONNAIRE Cycle: Revenue Class of transactions: Cash receipts Are prelists prepared for mail receipts? | Are checks restrictively endorsed on receipt? Are prelists independently reconciled with daily cash summaries? Are cash registers used for over-the-counter receipts? Are cash registers read daily and reconciled to cash on hand by supervisors? Is cash deposited in bank daily and intact? Is there reconciliation of deposits and cash summaries in treasurer's office? Do only authorized persons handle and deposit cash? Are cash discounts approved by accounts receivable clerks? Are persons who handle cash prohibited from journalizing and posting cash receipts transactions? Are persons who handle cash prohibited from making postings to the cus- tomer's ledger? Is board of director or officer authorization required for the opening and closing of bank accounts? Recording Transactions Are accounting personnel prohibited from handling cash? Is there internal verification of the agreement of daily cash summaries and cash receipts journal entries? Is there separation of duties between the journalizing of cash receipts trans- actions and postings to the customers' ledger? Maintaining Custody of Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts