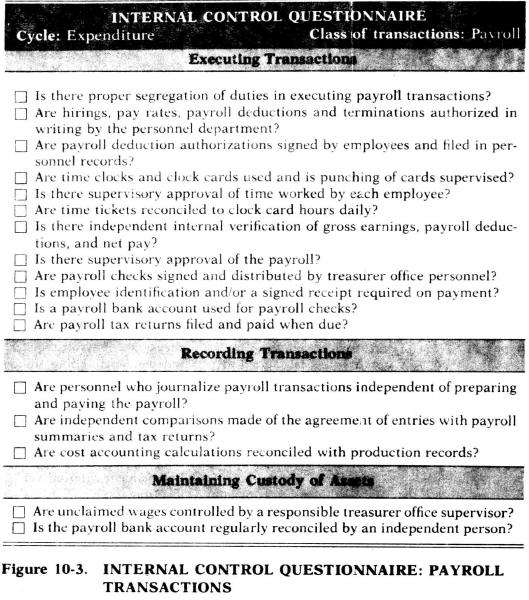

The following questions are included in Figure 10-3: 1. Are hirings, pay rates, payroll deductions, and terminations

Question:

The following questions are included in Figure 10-3:

1. Are hirings, pay rates, payroll deductions, and terminations a:t thorized in writing by the personnel department?

2. Are payroll deduction authorizations signed by employees and filed in personnel records?

3. Are time clocks and clock cards used and is punching of cards supervised?

4. Is there supervisory approval of time worked by each employee?

5. Is there independent internal verification of gross earnings, payroll deductions, and net pay?

6. Is there supervisory approval of the payroll?

7. Are payroll checks signed and distributed by treasurer office personnel?

8. Is employee identification and/or a signed receipt required on payment?

9. Are unclaimed wages controlled by a responsible treasurer office supervisor?

10. Are independent comparisons made of the agreement of entries with payroll summaries and tax returns?

\section*{Required:}

a. Identify the internal accounting control objective to which each question relates (i.e., executing, recording, or custody).

b. Identify the function and specific internal control objective to which the question pertains.

c. Indicate the internal accounting control principle that is involved.

d. Identify an error or irregularity that may result from a "No" answer to each question.

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler