The Jones Company, located in Chicago, has been your client for many years. The company manufactures light

Question:

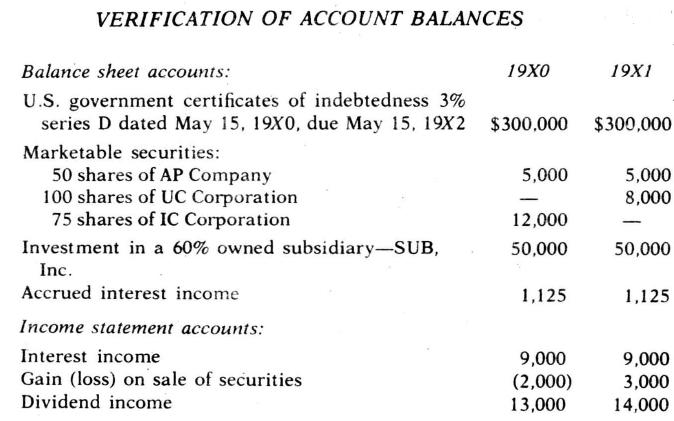

The Jones Company, located in Chicago, has been your client for many years. The company manufactures light machinery and has a calendar year closing. At December 31, 19X1 and 19X0 the following items appeared in the accounts applicable to marketable and investment securities. All investments in securities are carried on the books at cost and represent approximately 8 percent of total assets. Income from securities represents approximately 3 percent of income before federal income tax.

During 19X1, there were fourteen purchases and sales of marketable securities. The U.S. Government securities shown above are held at the Utah Banking Company. The AP Company securities are held in the Jones Company's safe and the UC Corporation securities are in a safety deposit box at the Chicago Bank Company, which is the company's bank. Access to the company's safe is limited to the treasurer or his assistant. Access to the safety deposit box is limited to any two of the treasurer, the assistant treasurer, or the controller. The securities of SUB, Inc. are also held by the Chicago Bank Company as collateral for a loan which the Jones Company has outstanding. SUB, Inc. has a June 30 closing and is audited by your firm.

Your tests of internal control indicate unusual strengths in the areas of cash receipts and cash disbursements. The treasurer is responsible for the physical control of securities while the controller is responsible for the recording of all transactions affecting securities. An assistant to the assistant controller maintains an investment ledger which shows the name of each investment, the number of shares held or the face value of bonds, the date of purchase and sale, if applicable, the cost, the physical location of the securities and the income thereon. This person prepares monthly statements of securities on hand showing their description and cost. All purchases and sales of securities are authorized by the company's finance committee. The following audit program has been prepared for the examination of securities at December \(31,19 \times 1\).

1. U.S. Government securities:

a. Prepare a schedule of the securities at December 31, 19X1:

b. Obtain direct confirmation from the Utah Banking Company as to description and amount of securities held.

c. Trace the confirmation to the schedule and so indicate.

d. Verify the interest earned for the year and accrued interest receivable at December 31, 19X1.

e. Trace the appropriate totals to the gen ' al ledger accounts.

2. Marketable securities:

a. Prepare an analysis of the securities account for the year under audit, including the market value of the securities at December 31, \(19 \times 1\).

b. Count AP Company securities at the company's office at the close of business on December 31, 19X1. Inspection of the securities should be in the presence of client's representative. Note the time of count, name of client's representative and the name of the auditor on the count sheet. Accompanied by the client's representative, inspect the UC Corporation securities at the Chicago Bank Company. Inspection should be completed at the close of business on December 31, 19X1. The same information should be shown on this count sheet as is indicated to be appropriate for the count sheet mentioned above. The count sheets should show the number of shares, the full name of security and the type of security (preferred or common shares).

c. Vouch purchases and sales by reference to broker's advices. Compare authorizations of the finance committee to the schedule.

d. Compare dividends received for the year with a published dividend record.

e. Verify the recorded gain or loss on sale of securities.

f. Trace the appropriate totals on the schedule to the general ledger accounts.

3. Investment in \(60 \%\) owned subsidiary-SUB, Inc.:

a. Request the Chicago Bank Company to confirm that it holds the securities for SUB, Inc. as collateral for a loan. The amount payable to the bank may be confirmed concurrently.

b. Review the monthly statements of SUB, Inc. since your latest examination and compare them with the audited statements at June 30. Obtain an explanation of all unusual transactions and fluctuations.

c. Discuss the December \(31,19 X 1\) financial statements with the management of the company. Inquire as to material amounts not recorded.

d. Establish that the intercompany accounts are in agreement at December 31.

e. Record the company's equity in the net assets and net income of SUB, Inc. at December 31, \(19 X 1\).

Required:

a. List the audit procedures that you believe are appropriate and identify the audit objective(s) to which each procedure relates.

b. List the audit procedures that you believe are inappropriate and give the reasons for your conclusion.

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler