Question:

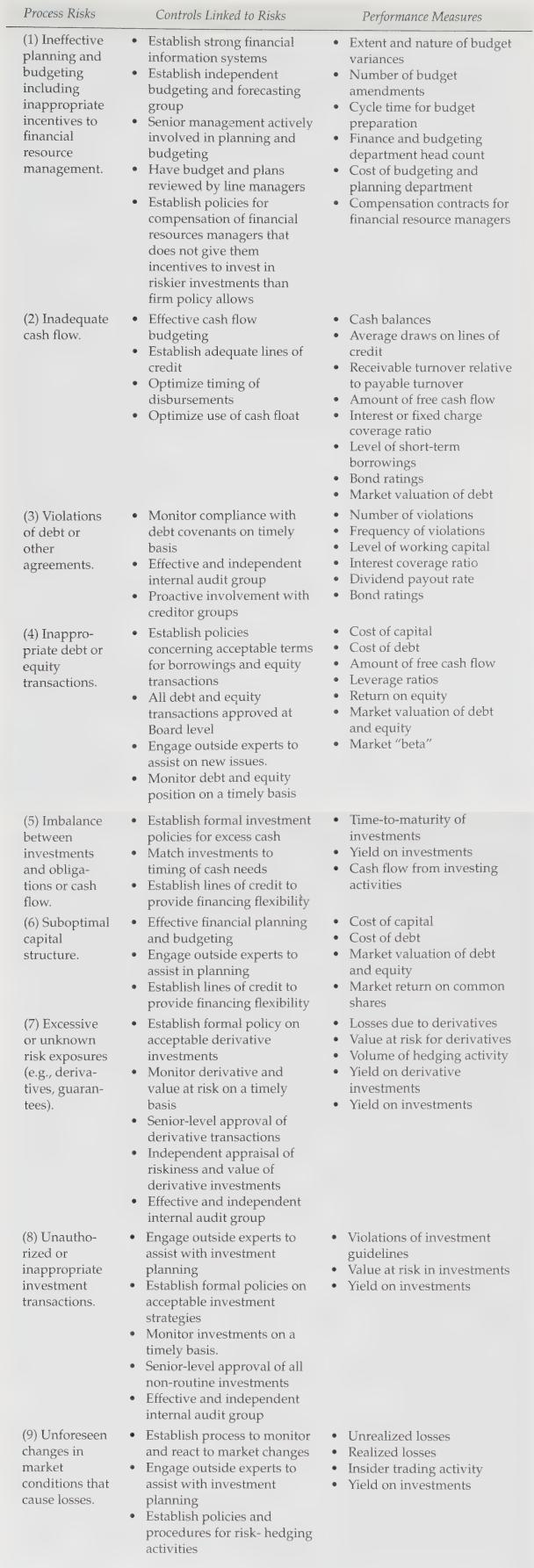

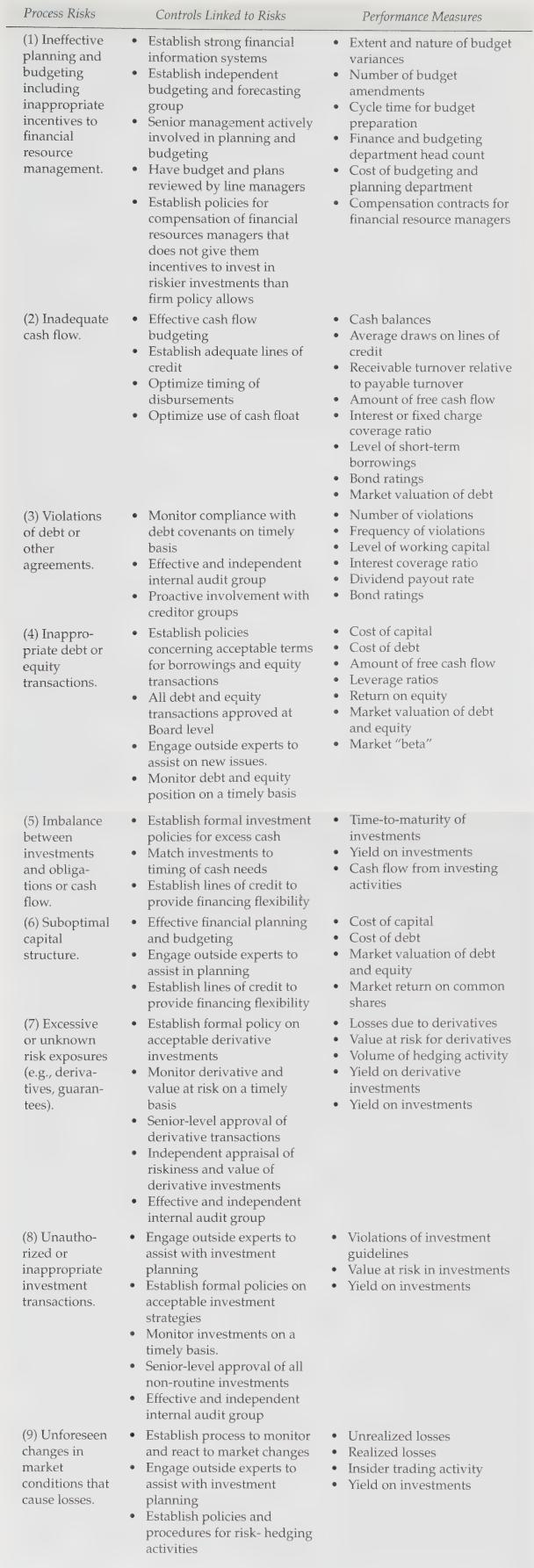

Consider an internal threat analysis for the loan management process for the commercial bank segment of a large financial banking institution (e.g., Bank of America, Deutsche Bank, etc.). Using Figure 13-7 as a guide:

a. Describe the people risks, direct process risks, and indirect process risks associated with a move to shift the bank's loan portfolio to include businesses and individuals with lower credit ratings but the potential for earning higher rates of return.

b. For each risk, describe a control that might be put in place to address the risk. Consider performance reviews and monitoring, segregation of duties, processing controls, and physical controls.

Figure 13-7

Transcribed Image Text:

Process Risks (1) Ineffective planning and budgeting including inappropriate incentives to financial resource management. (2) Inadequate cash flow. (3) Violations of debt or other agreements. (4) Inappro- priate debt or equity transactions. (5) Imbalance between investments and obliga- tions or cash flow. (6) Suboptimal capital structure. (7) Excessive or unknown risk exposures (e.g., deriva- tives, guaran- tees). (8) Unautho- rized or inappropriate investment transactions. (9) Unforeseen changes in market conditions that cause losses. . Controls Linked to Risks Establish strong financial information systems Establish independent budgeting and forecasting group Senior management actively involved in planning and budgeting Have budget and plans reviewed by line managers Establish policies for compensation of financial resources managers that does not give them incentives to invest in riskier investments than firm policy allows Effective cash flow budgeting Establish adequate lines of credit Optimize timing of disbursements Optimize use of cash float Monitor compliance with debt covenants on timely basis Effective and independent internal audit group Proactive involvement with creditor groups Establish policies concerning acceptable terms for borrowings and equity transactions All debt and equity transactions approved at Board level Engage outside experts to assist on new issues. Monitor debt and equity position on a timely basis Establish formal investment policies for excess cash Match investments to timing of cash needs Establish lines of credit to provide financing flexibility Effective financial planning and budgeting Engage outside experts to assist in planning Establish lines of credit to provide financing flexibility Establish formal policy on acceptable derivative investments Monitor derivative and value at risk on a timely basis Senior-level approval of derivative transactions Independent appraisal of riskiness and value of derivative investments Effective and independent internal audit group Engage outside experts to assist with investment planning Establish formal policies on acceptable investment strategies Monitor investments on a timely basis. Senior-level approval of all non-routine investments Effective and independent internal audit group Establish process to monitor and react to market changes Engage outside experts to assist with investment planning Establish policies and procedures for risk-hedging activities Performance Measures Extent and nature of budget variances Number of budget amendments Cycle time for budget preparation Finance and budgeting department head count Cost of budgeting and planning department Compensation contracts for financial resource managers Cash balances Average draws on lines of credit Receivable turnover relative to payable turnover Amount of free cash flow Interest or fixed charge coverage ratio Level of short-term borrowings Bond ratings Market valuation of debt Number of violations Frequency of violations Level of working capital Interest coverage ratio Dividend payout rate Bond ratings Cost of capital Cost of debt Amount of free cash flow Leverage ratios Return on equity Market valuation of debt and equity Market "beta" Time-to-maturity of investments Yield on investments Cash flow from investing activities Cost of capital Cost of debt Market valuation of debt and equity Market return on common shares Losses due to derivatives Value at risk for derivatives Volume of hedging activity Yield on derivative investments Yield on investments Violations of investment guidelines Value at risk in investments Yield on investments Unrealized losses Realized losses Insider trading activity Yield on investments