Question:

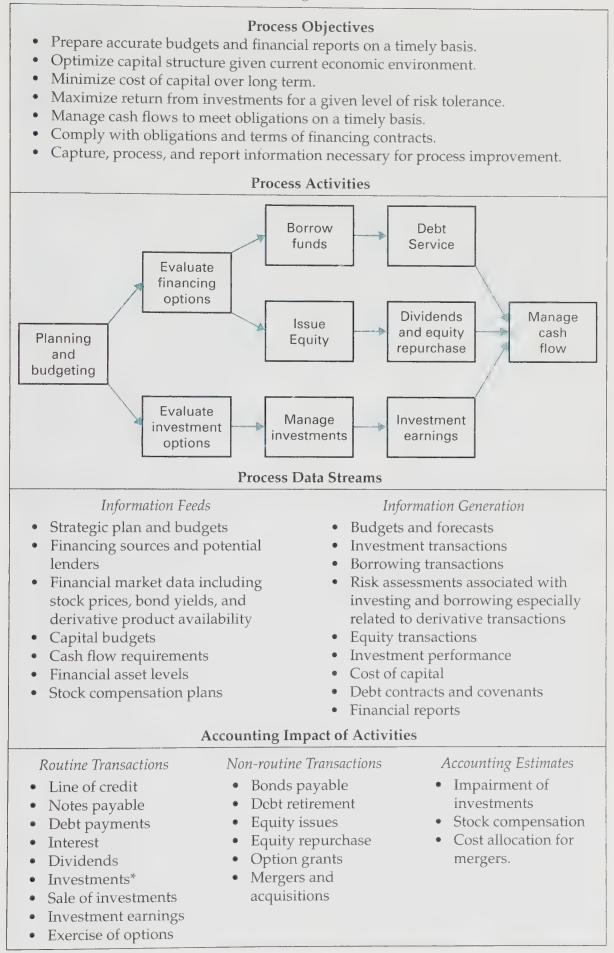

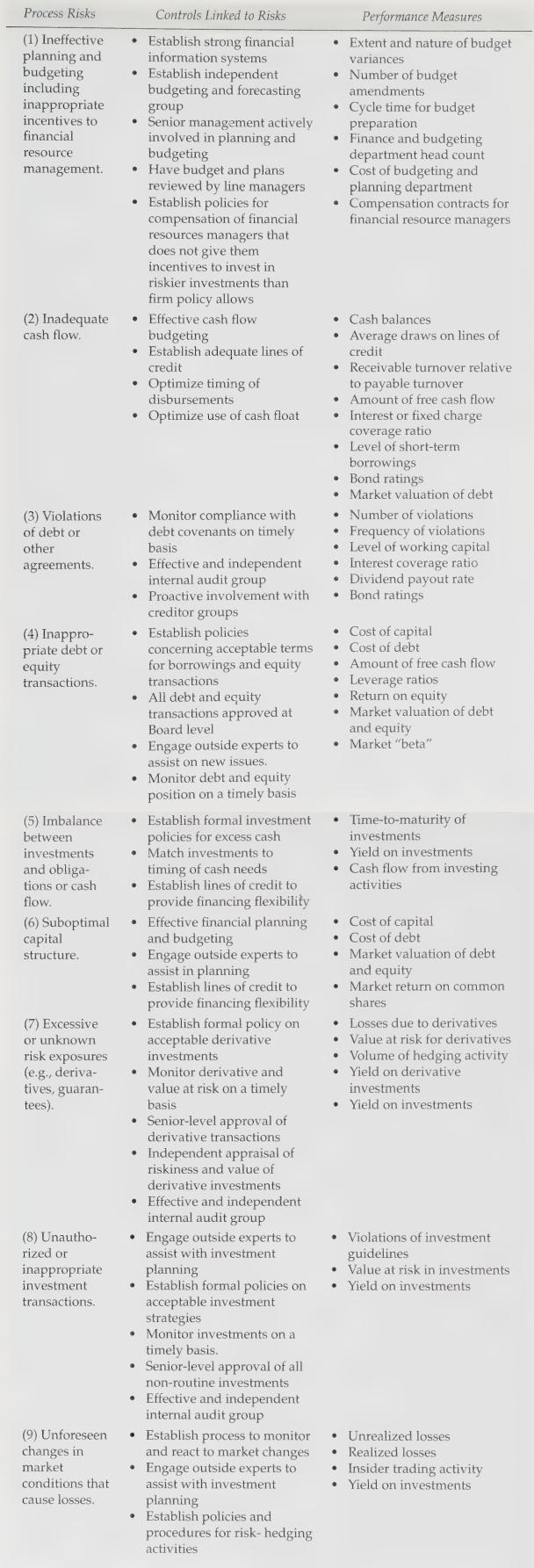

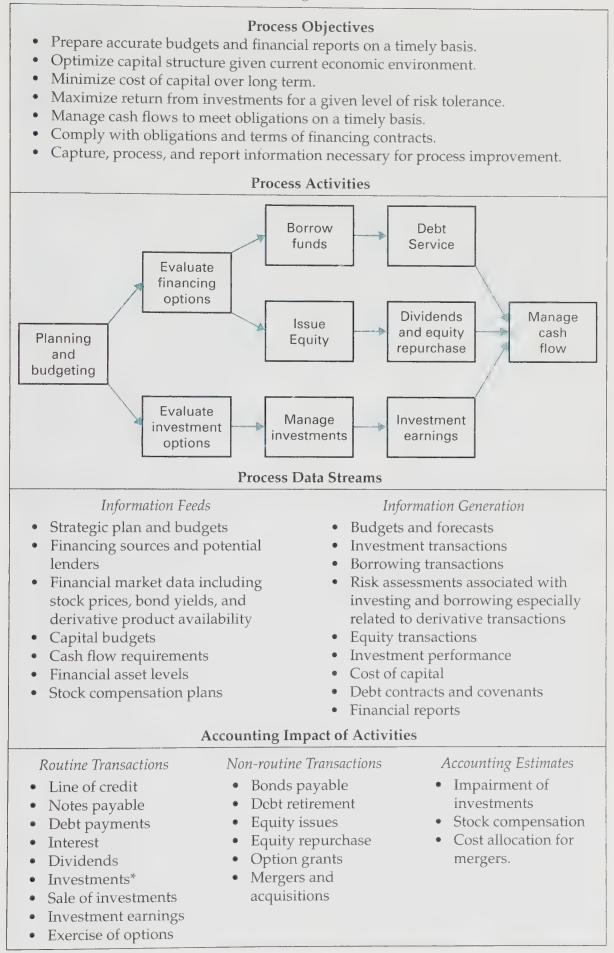

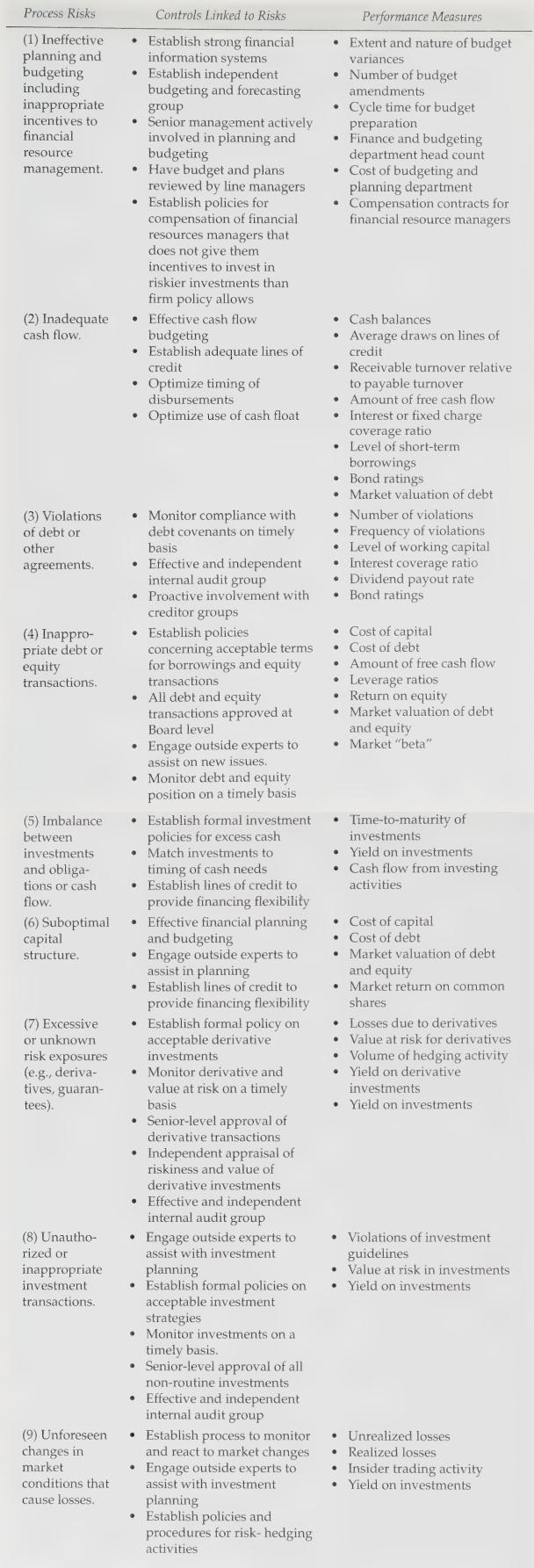

Organizations often will utilize third parties to perform their resource management processes. For example, organizations can utilize investment banks to perform financial asset management to conduct many of the activities shown in Figure 13-6. Access Credit Suisse's web site and research the descriptions and product offerings under asset management. Use this information and Figures 13-6 and Figure 13-7 to create an internal threat analysis for organizations that opt to use Credit Suisse to perform financial resource management.

Figure 13-6

Figure 13-7

Transcribed Image Text:

Process Objectives Prepare accurate budgets and financial reports on a timely basis. Optimize capital structure given current economic environment. Minimize cost of capital over long term. Maximize return from investments for a given level of risk tolerance. Manage cash flows to meet obligations on a timely basis. . Comply with obligations and terms of financing contracts. Capture, process, and report information necessary for process improvement. Process Activities Planning and budgeting Borrow funds Debt Service Evaluate financing options Dividends Manage Issue Equity and equity repurchase cash flow Evaluate investment Manage investments options Investment earnings Information Feeds Process Data Streams Strategic plan and budgets Financing sources and potential lenders Financial market data including stock prices, bond yields, and derivative product availability Capital budgets Cash flow requirements Financial asset levels Stock compensation plans Routine Transactions Line of credit Notes payable Debt payments Interest Dividends Investments* Sale of investments Investment earnings Exercise of options Information Generation Budgets and forecasts Investment transactions Borrowing transactions Risk assessments associated with investing and borrowing especially related to derivative transactions Equity transactions Investment performance Cost of capital Debt contracts and covenants Financial reports Accounting Impact of Activities Non-routine Transactions Bonds payable Debt retirement Equity issues . Equity repurchase Option grants Mergers and acquisitions Accounting Estimates Impairment of investments Stock compensation Cost allocation for mergers.