The firm of Le and Lysius was conducting the audit of Coomes Molding Corporation for the fiscal

Question:

The firm of Le and Lysius was conducting the audit of Coomes Molding Corporation for the fiscal year ended October 31. Michelle Le, the partner in charge of the audit, decides that MUS is the appropriate sampling technique to use in order to audit Coomes’ inventory account. The balance in the inventory at October 31 was $4,250,000. Michelle has established the following: risk of incorrect acceptance = 5% (i.e., the desired confidence level of 95%), tolerable misstatement = $212,500, and expected misstatement = $63,750.

Required:

a. Calculate the sample size and sampling interval.

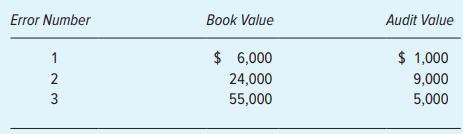

b. Hon Zhu, staff accountant, performed the audit procedures listed in the inventory audit program for each sample item. Using the sample size computed in part (a), calculate the upper limit on misstatement based on the following misstatements. What should Hon conclude about Coomes’ inventory account?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Auditing & Assurance Services A Systematic Approach

ISBN: 978-1260687637

11th Edition

Authors: William F Messier Jr, Steven M Glover, Douglas F Prawitt