Question:

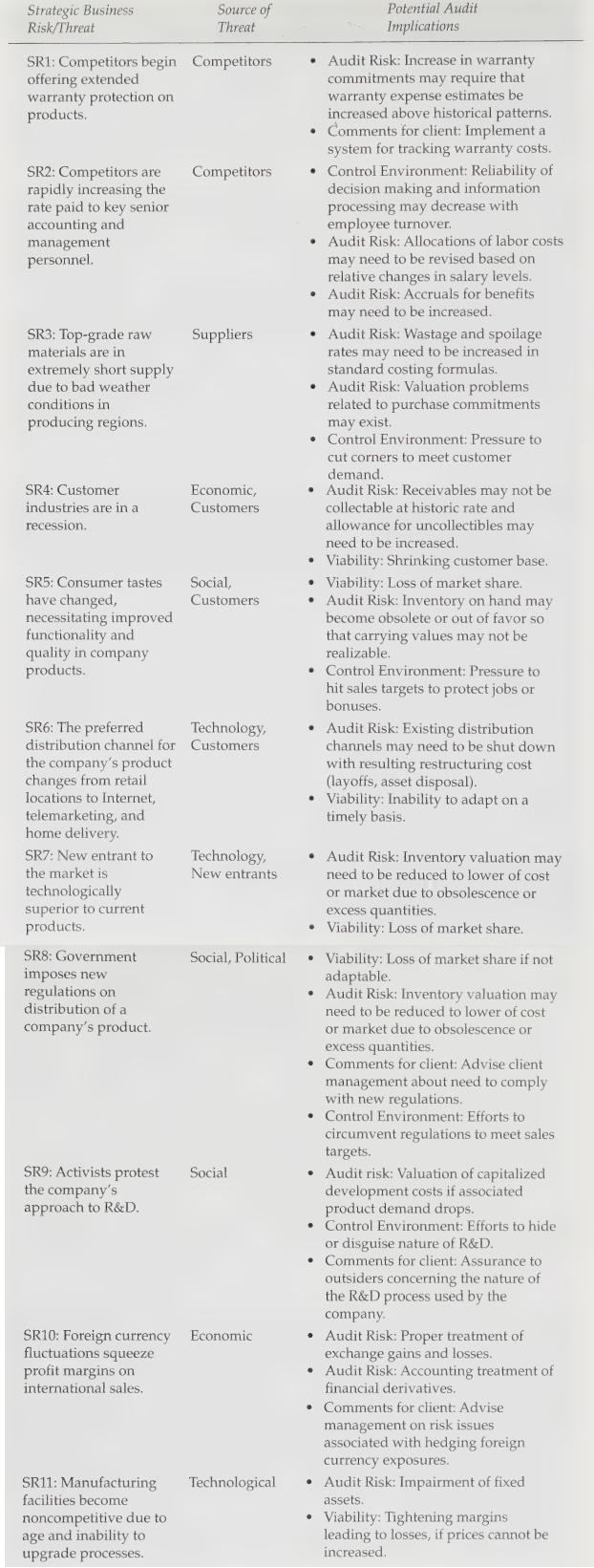

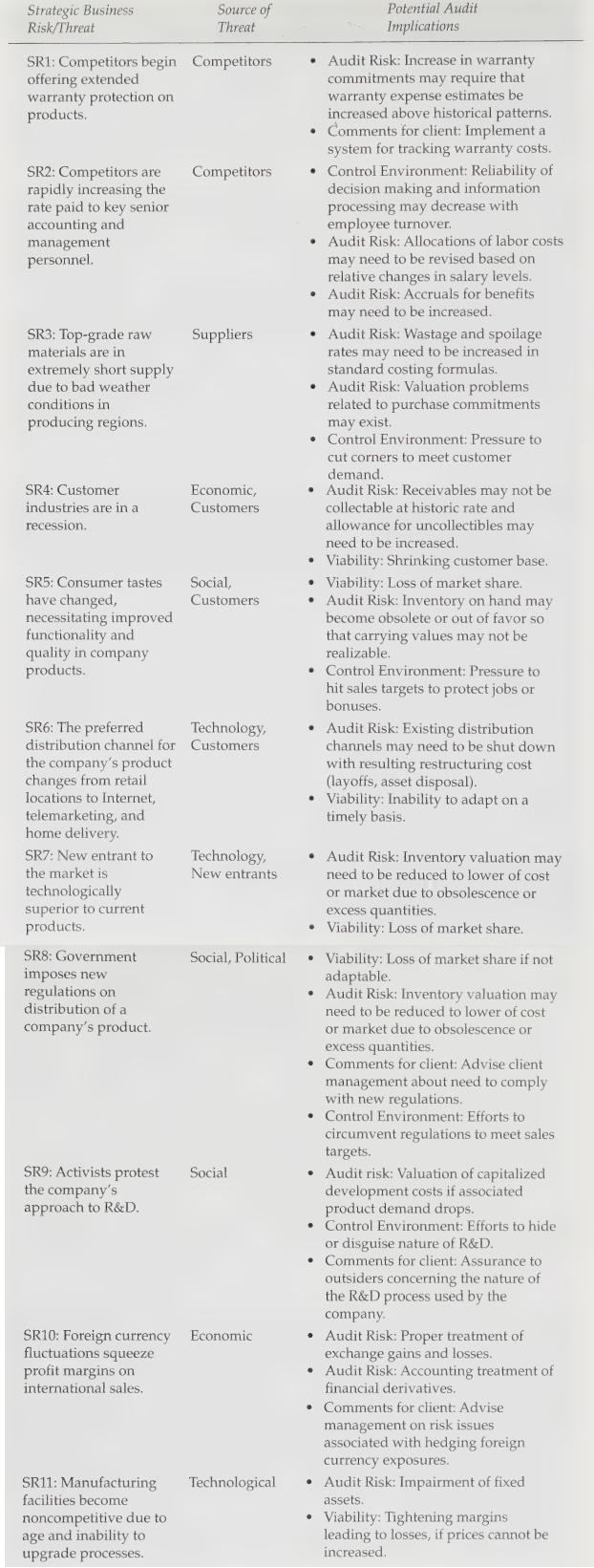

Use Figure 5-9 as a guide in determining the audit implications for the following possible business risks associated with Loblaw's, the largest food distributor and one of the largest retail grocers in Canada.

- The grocery industry is in a state of decline, as new competitors not strictly in the business enter the market (such as Wal-Mart).

- Consumer needs are changing to include more demands for ready-prepared meals, premium brands, and private label brands.

- Loblaw's has begun offering financial services to its customers, including banking, a MasterCard, and insurance products.

- Failure to re-engineer distribution processes to include business-to-business electronic commerce could reduce ability to compete with Wal-Mart, which has extensive experience with this distribution process.

- The company is expanding its non-grocery inventory to counterattack market penetration by other types of retailers (for example, drug stores).

Figure 5-9

Transcribed Image Text:

Strategic Business Risk/Threat Source of Threat SR1: Competitors begin Competitors offering extended warranty protection on products. SR2: Competitors are Competitors rapidly increasing the rate paid to key senior accounting and management personnel. SR3: Top-grade raw Suppliers materials are in extremely short supply due to bad weather conditions in producing regions. SR4: Customer Economic, industries are in a Customers recession. SR5: Consumer tastes have changed, necessitating improved functionality and quality in company products. SR6: The preferred Social, Customers Technology, distribution channel for Customers the company's product changes from retail locations to Internet, telemarketing, and home delivery. SR7: New entrant to the market is technologically superior to current products. SR8: Government imposes new regulations on distribution of a company's product. Technology New entrants Social, Political SR9: Activists protest Social the company's approach to R&D. SR10: Foreign currency Economic fluctuations squeeze profit margins on international sales. SR11: Manufacturing facilities become noncompetitive due to age and inability to upgrade processes. Technological Potential Audit Implications Audit Risk: Increase in warranty commitments may require that warranty expense estimates be increased above historical patterns. Comments for client: Implement a system for tracking warranty costs. Control Environment: Reliability of decision making and information processing may decrease with employee turnover. Audit Risk: Allocations of labor costs may need to be revised based on relative changes in salary levels. Audit Risk: Accruals for benefits may need to be increased. Audit Risk: Wastage and spoilage rates may need to be increased in standard costing formulas. Audit Risk: Valuation problems related to purchase commitments may exist. Control Environment: Pressure to cut corners to meet customer demand. Audit Risk: Receivables may not be collectable at historic rate and allowance for uncollectibles may need to be increased. Viability: Shrinking customer base. Viability: Loss of market share. Audit Risk: Inventory on hand may become obsolete or out of favor so that carrying values may not be realizable. Control Environment: Pressure to hit sales targets to protect jobs or bonuses. Audit Risk: Existing distribution channels may need to be shut down with resulting restructuring cost (layoffs, asset disposal). Viability: Inability to adapt on a timely basis. Audit Risk: Inventory valuation may need to be reduced to lower of cost or market due to obsolescence or excess quantities. Viability: Loss of market share. Viability: Loss of market share if not adaptable. Audit Risk: Inventory valuation may need to be reduced to lower of cost or market due to obsolescence or excess quantities. Comments for client: Advise client management about need to comply with new regulations. Control Environment: Efforts to circumvent regulations to meet sales targets. Audit risk: Valuation of capitalized development costs if associated product demand drops. Control Environment: Efforts to hide or disguise nature of R&D. Comments for client: Assurance to outsiders concerning the nature of the R&D process used by the company. Audit Risk: Proper treatment of exchange gains and losses. Audit Risk: Accounting treatment of financial derivatives. Comments for client: Advise management on risk issues associated with hedging foreign currency exposures. Audit Risk: Impairment of fixed assets. Viability: Tightening margins leading to losses, if prices cannot be increased.