You are the audit senior who has recently been assigned to the year-end audit of Ontario Agra

Question:

You are the audit senior who has recently been assigned to the year-end audit of Ontario Agra Corporation (OAC). After the end of the audit fieldwork, the senior on the engagement resigned suddenly to care for his ill child. Most of the audit has been completed, and you have been given the responsibility to review the working paper files and ensure that all outstanding issues are dealt with, and to assist in finalizing the audit.

COMPANY BACKGROUND

OAC owns and operates over 400 acres of greenhouse gardens in southern Ontario, and produces several types of vegetables for most of the year. OAC started operations in 2005 with 50 acres under production, and has been growing steadily ever since by acquiring adjacent land and expanding its greenhouse buildings.

OAC was founded by two entrepreneurs, Holly Green and Poppy Oakes. Each owns 25 percent of the company. The remaining 50 percent is held by a group of 10 investors who are not active in the company?s operations. In the past few years, Holly has become very active with the Ontario Greenhouse Association and its Grow Local Campaign and she has had little time to devote to the day-to-day operations of OAC. As a result, in 2014, Holly, Poppy, and the 10 investors agreed that Poppy will be responsible for OAC?s day-to-day operations, Holly and the 10 investors must approve and agree to all major financial decisions that Poppy proposes, and audited financial statements must be provided to all shareholders. Because of her added duties, Poppy receives a 5 percent bonus on net income in excess of $100,000.

In 2014, OAC engaged your firm to perform the audit. Holly, Poppy, and the 10 investors meet semi-annually to approve the operating plan, major capital expenditures for the upcoming year, the financial statements, and Poppy?s bonus, and to review the auditor?s internal control report.

YOUR REVIEW OF WORKING PAPERS

Based on your review of previous years? audit working papers and OAC?s draft March 31, 2018, annual financial statements, you learned that OAC?s production is sold primarily to large grocery store chains and produce wholesalers in Canada and the United States. One customer, Wholesome Foods, accounts for about 40 percent of OAC?s total 2018 revenues, and its nine next largest customers account for about 30 percent of 2018 revenues. Products are delivered by third-party carriers or are picked up by customer trucks at OAC?s packaging plant.

The growing season for sweet peppers and tomatoes is March through November. Cucumbers can be produced all year long. The main raw material used in production is water. Other materials required are mainly growing medium, plant nutrient mixtures, and packaging materials. The greenhouse growing process is labour intensive. In 2017, OAC made a major overhaul of its operations and invested heavily in equipment to clean, sort, and package the vegetables so that they are attractive and appetizing once they reach the store shelves. The Government of Ontario provided financing for the equipment. A requirement of the financing is that OAC must provide audited financial statements.

OAC?s net income from the greenhouse business has been increasing steadily over the past four years, with profits rising as the production and sales volumes have increased significantly, while labour costs have been reduced by the investment the company made in 2013 for new processing equipment.

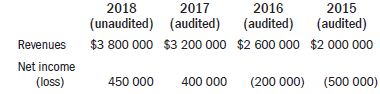

Materiality for the 2018 audit was set at $20 000. Information for the past four years? revenue and net income follows:

Based upon your review of the current year?s working papers and discussions with the audit team, you concluded that three issues were outstanding:

1. While inspecting the company?s equipment, the audit staff noted a large processing machine that appeared to be idle. The greenhouse manager told the staff that the machine had been purchased in 2016 for processing eggplants; however, several attempts to grow eggplants had failed due to insufficient sunlight in this part of Ontario. The manager has been trying to sell the equipment to greenhouse operations farther south, but it seems unlikely that it can be sold at a price that would cover the costs of moving it a great distance. The equipment?s carrying amount in the 2018 financial statements is $900 000.

2. The audit team was unable to reconcile the difference between the Wholesome Foods accounts receivable confirmation and OAC?s records. Wholesome Foods claims that OAC owes it $175 000 in promotional fees for prominent display and promotion of OAC products at its stores and has deducted this amount from its last payment to OAC. The controller was unable to locate a current contract between OAC and Wholesome Foods.

Poppy stated that she had negotiated a special deal with a buyer who is no longer with Wholesome Foods and that there is no money owing. She has instructed the controller not to book any adjustment.

3. In examining the April 2018 bank records, the audit staff noted that a payment of $1 500 000 was received on April 15. According to OAC?s controller, this amount is the total amount paid by a real estate development company, owned by Poppy?s husband, for its interest in a joint venture with OAC to develop five acres of OAC?s land. The audit team also noted that Poppy?s husband was paid $50 000 for consulting services over the year. The audit team had requested copies of the purchase agreement and the consulting contract. The controller provided a copy of the purchase agreement and noted that Holly and the investors had authorized the joint venture. However, there was no evidence of a consulting contract or authorization.

The controller advised the audit team that the fee did not meet the criteria of a major financial decision and no authorization was required.

The partner has asked you to prepare a memo outlining all outstanding issues so he can advise Holly and Poppy when the audit should be complete so that they can arrange a meeting of the investor group.

REQUIRED

a. Prepare a memo to the partner explaining the risk of material misstatement for each outstanding issue and what audit procedures are required in order to resolve each issue.

b. Prepare a separate memo outlining the issues that should be reported to those in charge of governance (the 10 investors, Holly, and Poppy).

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Auditing The Art and Science of Assurance Engagements

ISBN: 978-0134613116

14th Canadian edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Joanne C. Jones