Question:

The form and content of an audit report are affected by environmental factors such as the legal and economic circumstances, as well as the accounting and auditing practices used in each jurisdiction. Despite efforts to harmonize the accounting and auditing practices within the EU, there are still differences regarding national auditing standards governing the form and content of auditors’ reports for statutory audit of financial statements within member states. European Commission rules requiring public companies within the EU to comply with International Financial Reporting Standards (IFRSs) are part of a global strategy to harmonize financial reporting within EU member states.

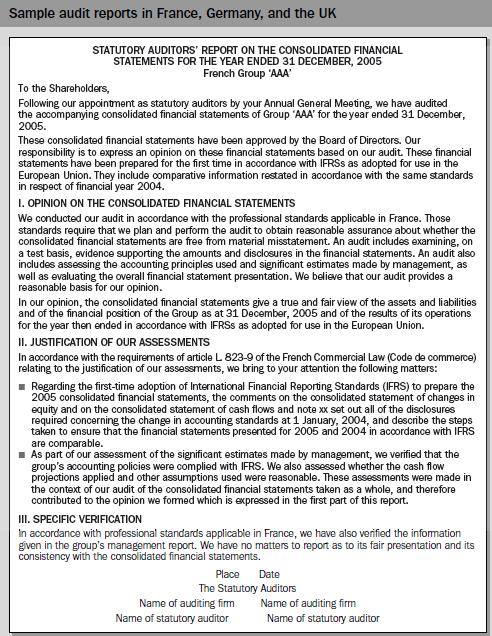

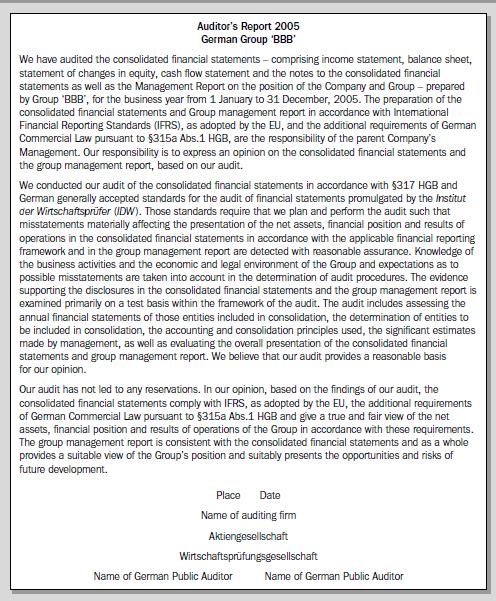

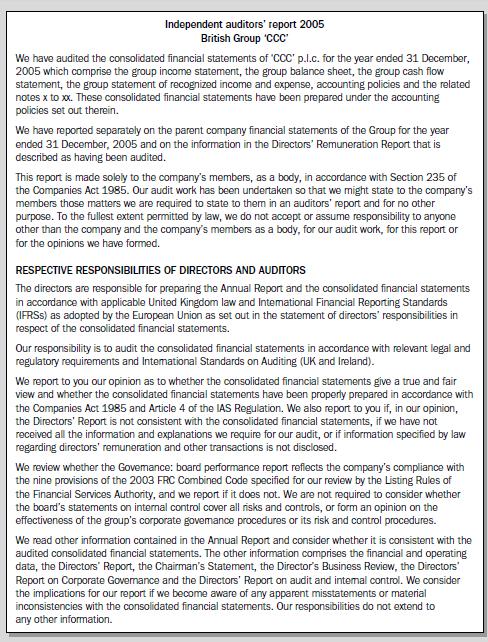

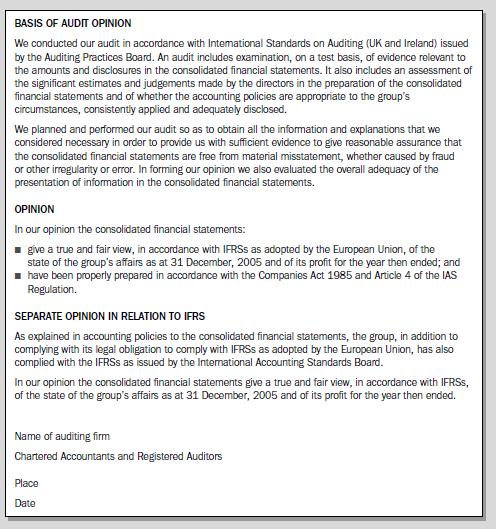

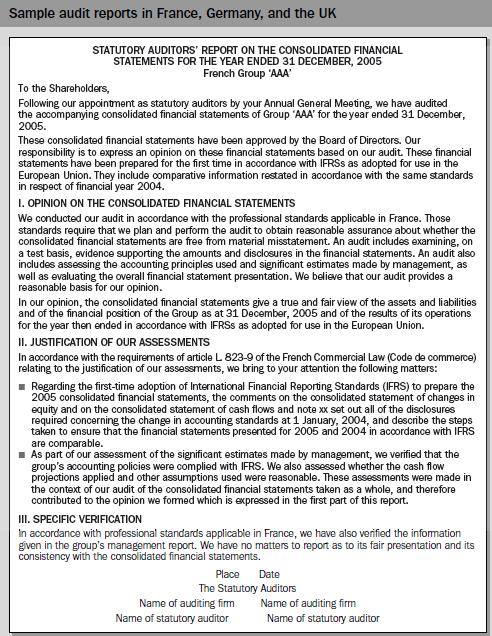

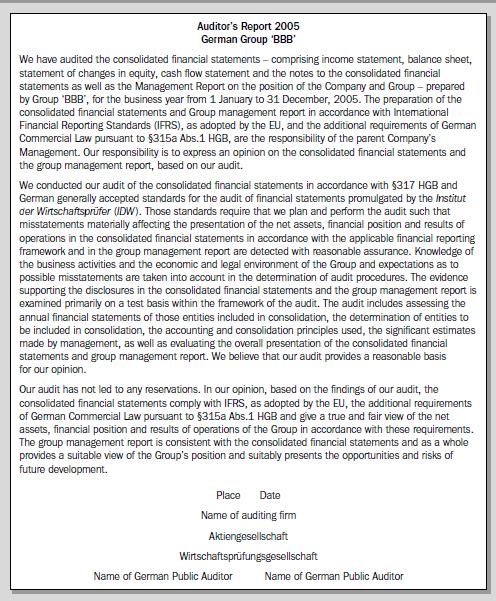

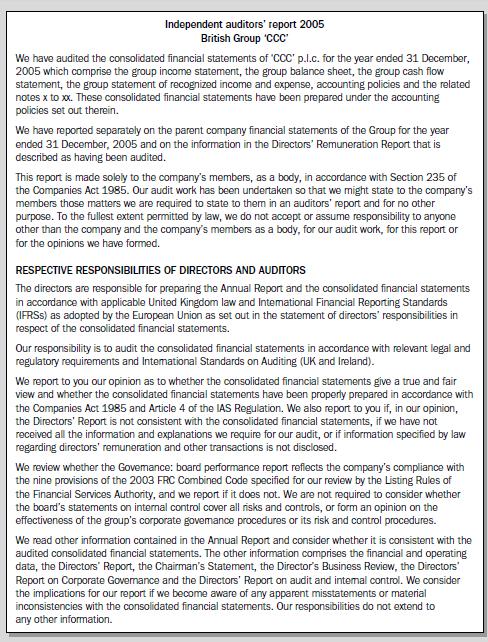

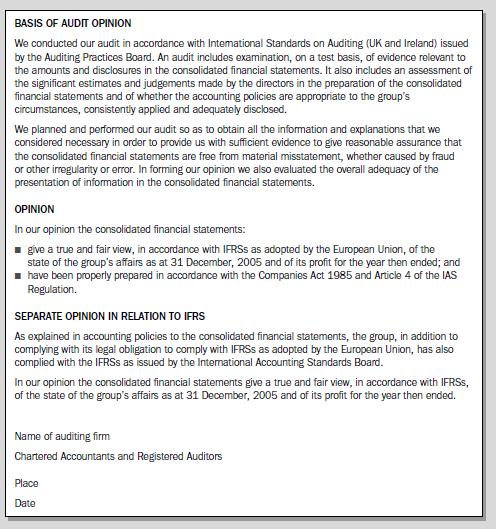

Figure 12.11

shows the format of audit reports of three publicly listed companies within the EU for the year ended 31 December, 2005 (France, Germany and the UK). All three reports are written in standard unqualified format to facilitate their comparisons. You are asked to read carefully the reports and discuss the following points:

(a) Describe the form and the content of each report by making reference to the points raised in the chapter in terms of title of the report, addressing the report, introductory paragraph, scope paragraph, opinion paragraph and date of report.

(b) Discuss the particular characteristics of each report by considering the following:

■ Statutory law and regulations;

■ Accounting and auditing practices;

■ Corporate governance and management’s responsibilities;

■ Auditor’s responsibility;

■ Other elements you may think necessary to comment on with regard to economic, legal, accounting, auditing and reporting matters of the above-mentioned countries.

Transcribed Image Text:

Sample audit reports in France, Germany, and the UK STATUTORY AUDITORS' REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER, 2005 French Group 'AAA' To the Shareholders, Following our appointment as statutory auditors by your Annual General Meeting, we have audited the accompanying consolidated financial statements of Group 'AAA' for the year ended 31 December, 2005. These consolidated financial statements have been approved by the Board of Directors. Our responsibility is to express an opinion on these financial statements based on our audit. These financial statements have been prepared for the first time in accordance with IFRSS as adopted for use in the European Union. They include comparative information restated in accordance with the same standards in respect of financial year 2004. I. OPINION ON THE CONSOLIDATED FINANCIAL STATEMENTS We conducted our audit in accordance with the professional standards applicable in France. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. In our opinion, the consolidated financial statements give a true and fair view of the assets and liabilities and of the financial position of the Group as at 31 December, 2005 and of the results of its operations for the year then ended in accordance with IFRSS as adopted for use in the European Union. II. JUSTIFICATION OF OUR ASSESSMENTS In accordance with the requirements of article L 823-9 of the French Commercial Law (Code de commerce) relating to the justification of our assessments, we bring to your attention the following matters: Regarding the first-time adoption of International Financial Reporting Standards (IFRS) to prepare the 2005 consolidated financial statements, the comments on the consolidated statement of changes in equity and on the consolidated statement of cash flows and note xx set out all of the disclosures required concerning the change in accounting standards at 1 January, 2004, and describe the steps taken to ensure that the financial statements presented for 2005 and 2004 in accordance with IFRS are comparable. As part of our assessment of the significant estimates made by management, we verified that the group's accounting policies were complied with IFRS. We also assessed whether the cash flow projections applied and other assumptions used were reasonable. These assessments were made in the context of our audit of the consolidated financial statements taken as a whole, and therefore contributed to the opinion we formed which is expressed in the first part of this report. III. SPECIFIC VERIFICATION In accordance with professional standards applicable in France, we have also verified the information given in the group's management report. We have no matters to report as to its fair presentation and its consistency with the consolidated financial statements. Place Date The Statutory Auditors Name of auditing firm Name of statutory auditor Name of auditing firm Name of statutory auditor