The following audit procedures were performed in the audit of inventory. The audit procedures assume the auditor

Question:

The following audit procedures were performed in the audit of inventory. The audit procedures assume the auditor has obtained the inventory count records that list the client’s inventory. The balance assertions are also included.

AUDIT PROCEDURES

1. Using audit software, extend unit prices times quantity, foot the extensions, and compare the total with the general ledger.

2. Trace selected quantities from the inventory listing to the physical inventory to make sure the items exist and the quantities are the same.

3. Question operating personnel about the possibility of obsolete or slow-moving inventory.

4. Select a sample of quantities of inventory in the factory warehouse, and trace each item to the inventory count sheets to determine if it has been included and if the quantity and description are correct.

5. Using both this year’s and last year’s inventory data files, compare quantities on hand and unit prices, printing any with greater than a 30 percent or $15 000 variation from one year to the next.

6. Examine sales invoices and contracts with customers to determine if any goods are out on consignment with customers. Similarly, examine vendors’ invoices and contracts with vendors to determine if any goods on the inventory listing are owned by vendors.

7. Send letters directly to third parties who hold the client’s inventory and request that they respond directly to us.

REQUIRED

a. Identify the type of audit evidence used for each audit procedure.

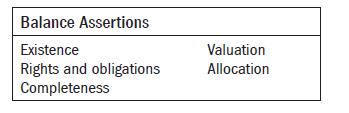

b. Identify the balance assertion(s) tested by each audit procedure.

Step by Step Answer:

Auditing The Art And Science Of Assurance Engagements

ISBN: 9780136692089

15th Canadian Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan, Joanne C. Jones