The following items were discovered during the December 31, 2020, audit of the financial statements of Westmoreland

Question:

The following items were discovered during the December 31, 2020, audit of the financial statements of Westmoreland Corporation.

1. The company’s financial statements did not include an accrual for bonuses earned by senior management in 2020 but payable in March 2021. The aggregate bonus amount was $125 000.

2. Equipment originally costing $725 000 was fully amortized with a remaining residual value of $60 000. This equipment was sold for $85 000 on December 29, 2020. The purchaser agreed to pay for the equipment by January 15, 2021.

3. Based on close examination of the client’s aged accounts receivable trial balance and correspondence files with customers, the auditor determined that management’s allowance for bad debts is overstated by $44 000.

4. Expenses totalling $52 000 associated with the maintenance of equipment were inappropriately debited to the equipment account.

5. Marketing expenses of $43 000 were incorrectly classified as cost of goods sold.

6. The company received new computer equipment on January 3, 2021, that was ordered and shipped FOB shipping point to Westmoreland on December 27, 2020. No entry has been recorded for this purchase that was financed by a long-term note payable due in full June 30, 2020.

REQUIRED

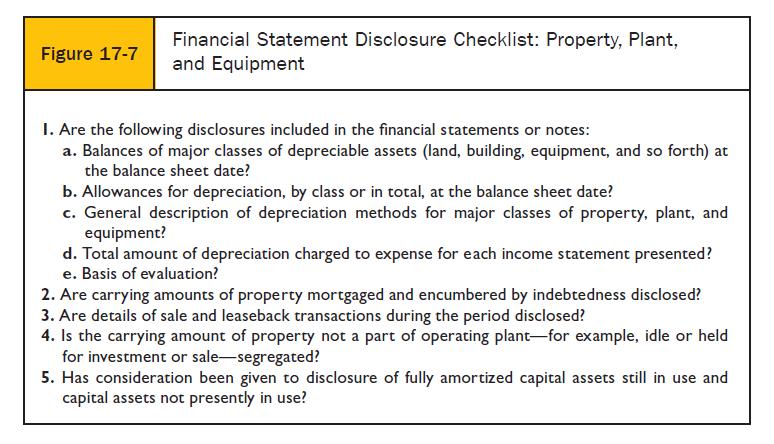

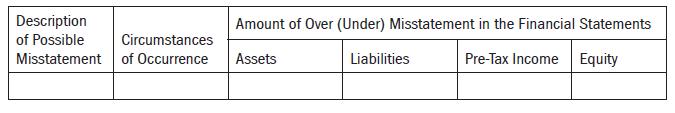

a. Prepare a Summary of Identified Misstatements Audit Schedule using the following format (see Figure 17-7 as an example):

Data from in Figure 17-7

b. Planning materiality for the audit of Westmoreland financial statements is $100 000 and performance materiality is $75 000. Assuming that Westmoreland management does not want to post any of the identified misstatements to the adjustments, what is your conclusion about the financial statements?

Step by Step Answer:

Auditing The Art And Science Of Assurance Engagements

ISBN: 9780136692089

15th Canadian Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan, Joanne C. Jones