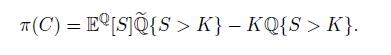

Exercise 5.1 Suppose that the price of a call option is given by (C) = E Q

Question:

Exercise 5.1 Suppose that the price of a call option is given by π(C) =

EQ[{S − K}+], where S denotes the future price of the underlying asset.

Supposing S > 0 a.s., define η = S/EQ[S], and consider a new probability measure eQ by eQ

(A) = EQ[η1A]. Show that

Here, eQ {S > K} is the probability that the call option will be in-the-money, that is, S > K, under the new probability measure eQ ; cf. (5.15).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Stochastic Processes With Applications To Finance

ISBN: 9781439884829

2nd Edition

Authors: Masaaki Kijima

Question Posted: