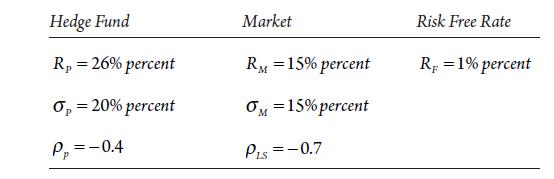

Calculate Jensens alpha. Using the following output to answer each of the question: Hedge Fund Rp =

Question:

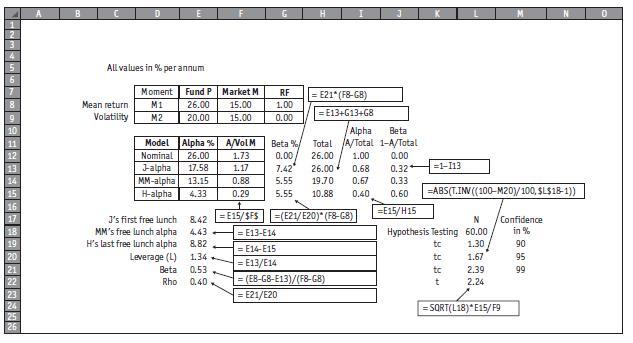

Calculate Jensen’s alpha.

Using the following output to answer each of the question:

Transcribed Image Text:

Hedge Fund Rp = 26% percent = 20% percent Pp=-0.4 Market RM = 15% percent = 15% percent Risk Free Rate RF = 1% percent PLS =-0.7

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

Answered By

Rustia Melrod

I am a retired teacher with 6 years of experience teaching various science subjects to high school students and undergraduate students. This background enables me to be able to help tutor students who are struggling with the science of business component of their education. Teaching difficult subjects has definitely taught me patience. There is no greater joy for me than to patiently guide a student to the correct answer. When a student has that "aha!" moment, all my efforts are worth it.

The Common Core standards are a useful yardstick for measuring how well students are doing. My students consistently met or exceeded the Common Core standards for science. I believe in working with each student's individual learning styles to help them understand the material. If students were struggling with a concept, I would figure out a different way to teach or apply that concept. I was voted Teacher of the Year six times in my career. I also won an award for Innovative Teaching Style at the 2011 National Teaching Conference.

4.90+

4+ Reviews

10+ Question Solved

Related Book For

Hedge Funds Structure Strategies And Performance

ISBN: 9780190607371

1st Edition

Authors: H. Kent Baker, Greg Filbeck

Question Posted:

Students also viewed these Business questions

-

Let A, B be sets. Define: (a) the Cartesian product (A B) (b) the set of relations R between A and B (c) the identity relation A on the set A [3 marks] Suppose S, T are relations between A and B, and...

-

CANMNMM January of this year. (a) Each item will be held in a record. Describe all the data structures that must refer to these records to implement the required functionality. Describe all the...

-

can someone solve this Modern workstations typically have memory systems that incorporate two or three levels of caching. Explain why they are designed like this. [4 marks] In order to investigate...

-

Consider three (ideally other) countries for which evidence features here. What are the key influences on cross-national comparative variation in the place and role of the HRM function?

-

What are the key assumptions implicit in the Deutsche-Telekom restructuring strategy for T-Mobile?

-

In what ways do you think that ratios are used to reduce lenders' risks? In what ways does their use in loan agreements shift risks from lenders to borrowers?

-

List the different safety measure guidelines of a theme park in your country. LO.1

-

For each of the following independent situations, calculate the amount(s) required. Required: 1. At the break-even point, Jefferson Company sells 115,000 units and has fixed cost of $349,600. The...

-

Entries for Bonds Payable, including bond redemption The following transactions were completed by Montague Inc., whose fiscal year is the calendar year: 20Y1 July 1. Issued $55,000,000 of 10-year, 9%...

-

Calculate Modiglianis alpha. Using the following output to answer each of the question: Hedge Fund Rp = 26% percent = 20% percent Pp=-0.4 Market RM = 15% percent = 15% percent Risk Free Rate RF = 1%...

-

Calculate the leverage factor L used by the manager. Using the following output to answer each of the question: Hedge Fund Rp = 26% percent = 20% percent Pp=-0.4 Market RM = 15% percent = 15% percent...

-

PepsiCo's financial statements are presented in Appendix A. Coca-Cola's financial statements are presented in Appendix B. Instructions (a) Based on the information contained in these financial...

-

Activity 1.4: When Less Becomes More For this activity, refer to the images shown. This is an activity which was performed for you if you do not have available two identical mirrors at home. But if...

-

! Required information [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced...

-

During the early part of winter, one morning, two hunters decided to go quail hunting on a property where the owner had given them permission to hunt. A nearby forest ranger saw the hunters and...

-

Required information [The following information applies to the questions displayed below.] Trini Company set the following standard costs per unit for its single product. Direct materials (30 pounds...

-

A horticulturist knows that the weights of honeybees that have previously visited her orchard are normally distributed with a mean of 0.87 grams, and a population standard deviation of 0.15 grams....

-

Consider again the box containing the five different coins described in Exercise 7. Suppose that one coin is selected at random from the box and is tossed repeatedly until a head is obtained. a. If...

-

What services are provided by the provincial and territorial governments?

-

Identify two ways to consider currency risk in an alpha measure based on an international asset pricing model.

-

Describe the difference between the world CAPM with a currency risk factor model and a two-factor IAPT model.

-

Indicate two situations in which an alpha measure based on the global three-factor model, which includes the world market portfolio, global size, and value factors, may fail to correctly estimate the...

-

Year-to-date, Yum Brands had earned a 3.70 percent return. During the same time period, Raytheon earned 4.58 percent and Coca-Cola earned 0.53 percent. If you have a portfolio made up of 40 percent...

-

Rate of Return If State Occurs State of Probability of Economy State of Economy Stock A Stock B Stock C Boom .15 .31 .41 .21 Good .60 .16 .12 .10 Poor .20 .03 .06 .04 Bust .05 .11 .16 .08 a. Your...

-

An investor wants to purchase a zero coupon bond from Timberlake Industries today. The bond will mature in exactly 5.00 years with a redemption value of $1,000. The investor wants a 12.00% annual...

Study smarter with the SolutionInn App