Question:

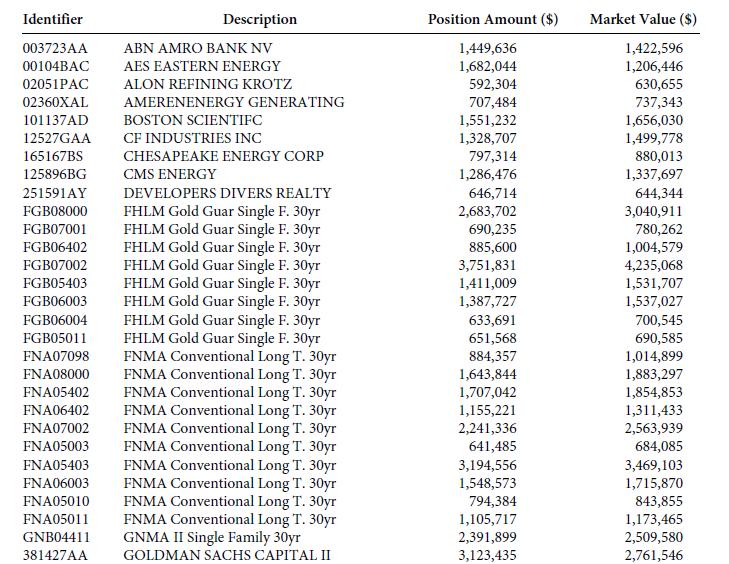

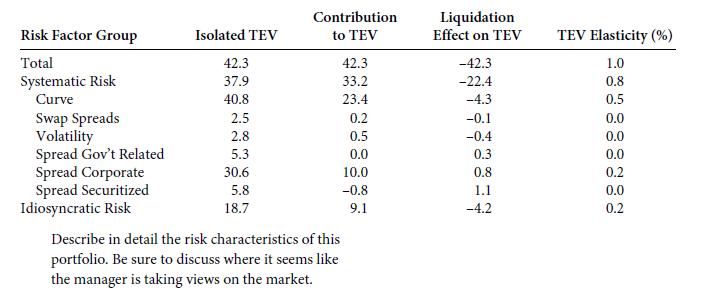

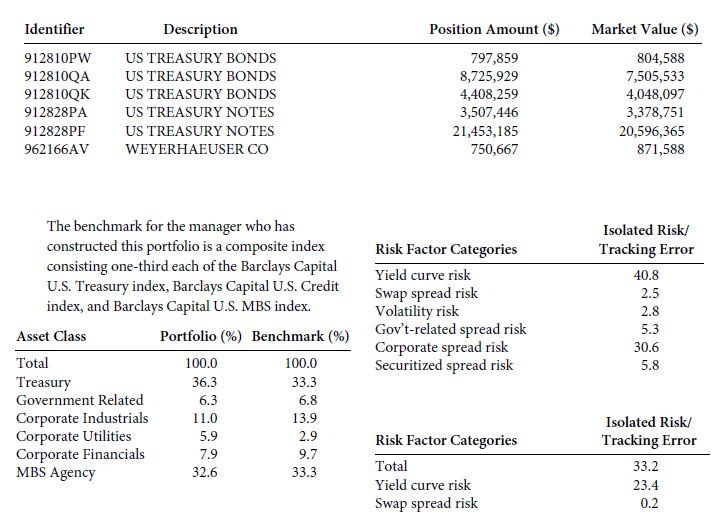

Following is a portfolio consisting of 50 bonds with a market value of $100 million as of April 29, 2011:

Transcribed Image Text:

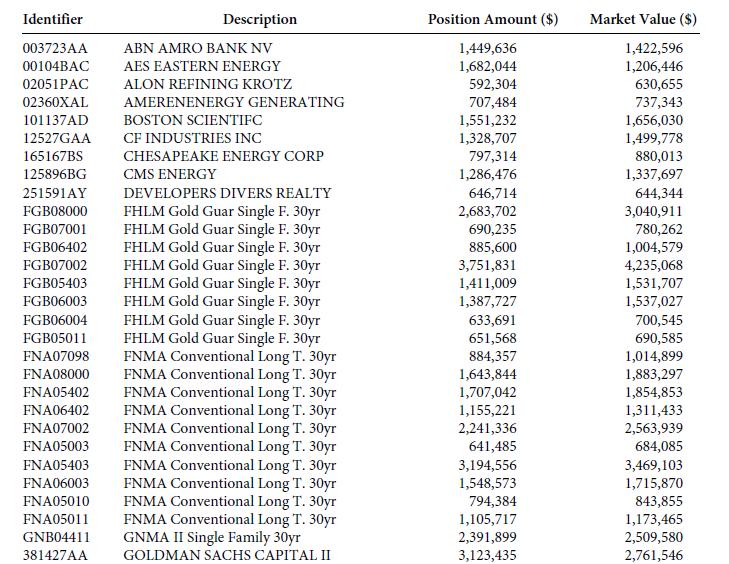

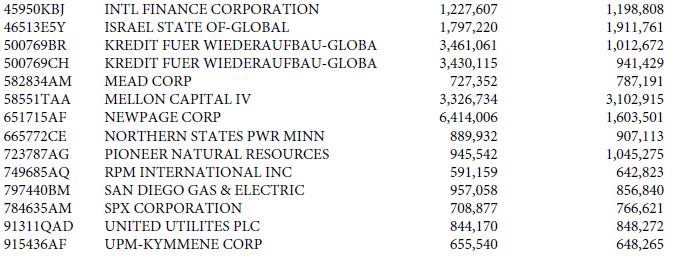

Identifier Description Position Amount ($) Market Value ($) 003723AA ABN AMRO BANK NV 1,449,636 00104BAC AES EASTERN ENERGY 1,682,044 1,422,596 1,206,446 02051PAC ALON REFINING KROTZ 592,304 630,655 02360XAL AMERENENERGY GENERATING 707,484 737,343 101137AD BOSTON SCIENTIFC 1,551,232 1,656,030 12527GAA CF INDUSTRIES INC 1,328,707 1,499,778 165167BS CHESAPEAKE ENERGY CORP 797,314 880,013 125896BG CMS ENERGY 1,286,476 1,337,697 251591AY DEVELOPERS DIVERS REALTY 646,714 644,344 FGB08000 FHLM Gold Guar Single F. 30yr 2,683,702 3,040,911 FGB07001 FHLM Gold Guar Single F. 30yr 690,235 780,262 FGB06402 FGB07002 FHLM Gold Guar Single F. 30yr 885,600 1,004,579 FHLM Gold Guar Single F. 30yr 3,751,831 4,235,068 FGB05403 FHLM Gold Guar Single F. 30yr 1,411,009 1,531,707 FGB06003 FHLM Gold Guar Single F. 30yr 1,387,727 1,537,027 FGB06004 FGB05011 FNA07098 FHLM Gold Guar Single F. 30yr FHLM Gold Guar Single F. 30yr 633,691 700,545 651,568 690,585 FNMA Conventional Long T. 30yr 884,357 1,014,899 FNA08000 FNMA Conventional Long T. 30yr 1,643,844 1,883,297 FNA05402 FNMA Conventional Long T. 30yr 1,707,042 1,854,853 FNA06402 FNMA Conventional Long T. 30yr 1,155,221 1,311,433 FNA07002 FNA05003 FNA05403 FNMA Conventional Long T. 30yr 2,241,336 2,563,939 FNMA Conventional Long T. 30yr 641,485 684,085 FNMA Conventional Long T. 30yr 3,194,556 3,469,103 FNA06003 FNMA Conventional Long T. 30yr 1,548,573 1,715,870 FNA05010 FNMA Conventional Long T. 30yr 794,384 843,855 FNA05011 FNMA Conventional Long T. 30yr 1,105,717 1,173,465 GNB04411 381427AA GNMA II Single Family 30yr 2,391,899 2,509,580 GOLDMAN SACHS CAPITAL II 3,123,435 2,761,546