Green Pastures is a 400-acre farm on the outskirts of the Kentucky Bluegrass, specializing in the boarding

Question:

Green Pastures is a 400-acre farm on the outskirts of the Kentucky Bluegrass, specializing in the boarding of broodmares and their foals. A recent economic downturn in the thoroughbred industry has led to a decline in breeding activities, and it has made the boarding business extremely competitive. To meet the competition, Green Pastures planned in 2017 to entertain clients, advertise more extensively, and absorb expenses formerly paid by clients such as veterinary and blacksmith fees.

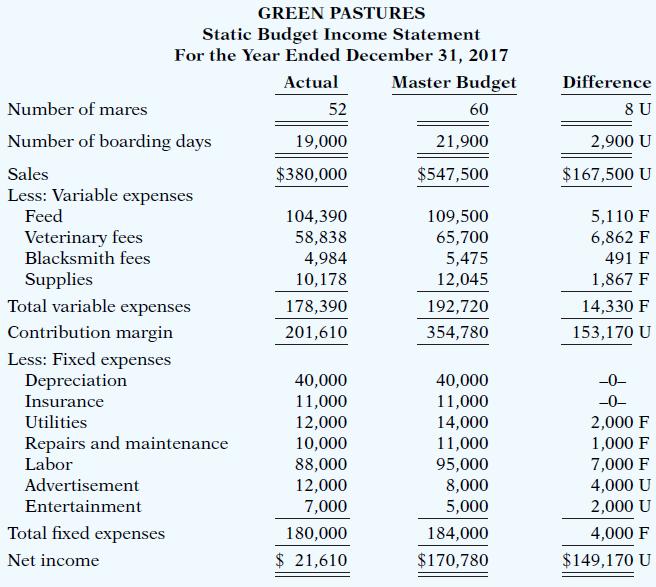

The budget report for 2017 is presented below. As shown, the static income statement budget for the year is based on an expected 21,900 boarding days at $25 per mare. The variable expenses per mare per day were budgeted: feed $5, veterinary fees $3, blacksmith fees $0.25, and supplies $0.55. All other budgeted expenses were either semi-fixed or fixed.

During the year, management decided not to replace a worker who quit in March, but it did issue a new advertising brochure and did more entertaining of clients.

Instructions

With the class divided into groups, answer the following.

(a) Based on the static budget report:

(1) What was the primary cause(s) of the loss in net income?

(2) Did management do a good, average, or poor job of controlling expenses?

(3) Were management’s decisions to stay competitive sound?

(b) Prepare a flexible budget report for the year.

(c) Based on the flexible budget report, answer the three questions in part (a) above.

(d) What course of action do you recommend for the management of Green Pastures?

Step by Step Answer:

Accounting Principles

ISBN: 978-1118875056

12th edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso