In the Assembly Department of Hannon Company, budgeted and actual manufacturing overhead costs for the month of

Question:

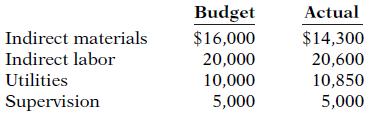

In the Assembly Department of Hannon Company, budgeted and actual manufacturing overhead costs for the month of April 2017 were as follows.

All costs are controllable by the department manager. Prepare a responsibility report for April for the cost center.

Transcribed Image Text:

Budget Actual Indirect materials Indirect labor $16,000 $14,300 20,000 20,600 10,850 5,000 Utilities 10,000 5,000 Supervision

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 81% (11 reviews)

Resp ons ibility Report For the Assembly Department of H annon Company For the Mont...View the full answer

Answered By

SHINKI JALHOTRA

I have worked with other sites like Course Hero as a tutor and I have great knowledge on IT skills.

0.00

0 Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 978-1118875056

12th edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso

Question Posted:

Students also viewed these Business questions

-

In the Assembly Department of Cobb Company, budgeted and actual manufacturing overhead costs for the month of April 2010 were as follows. All costs are controllable by the department manager. Prepare...

-

In the assembly department of Osaka Company, budgeted and actual manufacturing overhead costs for the month of April 2016 were as follows: The department manager can control all costs. Prepare a...

-

In the assembly department of Osaka Company, budgeted and actual manufacturing overhead costs for the month of April 2012 were as follows: ____________________________________Budget Actual Indirect...

-

A population of Ecuadorians have short stature. They have a rare genetic defect that affects the body's response to growth horm one, called Laron syndrome. Recent genetic studies have dem onstrated...

-

A researcher applied the carcinogenic (cancer-causing) compound benzo (a) pyrene to the skin of five mice, and measured the concentration in the liver tissue after 48 hours. The results (nmol/gm)...

-

On November 1, 2011, Olympic Company adopted a stock-option plan that granted options to key executives to purchase 40,000 shares of the companys $10 par value common stock. The options were granted...

-

What are typical symptoms of resistance to change, from an employee's perspective?

-

Rip Tide Company manufactures surfboards. Its standard cost information follows. Rip Tide has the following actual results for the month of June: Number of units produced and sold ....... 312 Number...

-

According to the text, which of the following is a formula to determine the future value of an annuity? (PMT/ i ) [(1 + i ) n 1] (PMT/ i ) [1 1/(1 + i ) n ] PMT/ i PV(1 + i ) n None of the above.

-

Hill-O-Beans Coffee Company blends four component beans into three final blends of coffee: one is sold to luxury hotels, another to restaurants, and the third to supermarkets for store label brands....

-

Data for Gundy Company are given in BE24-4. In March 2017, the company incurs the following costs in producing 100,000 units: direct materials $520,000, direct labor $596,000, and variable overhead...

-

The service division of Raney Industries reported the following results for 2017. Sales.....................................................................$500,000 Variable...

-

The following data was extracted from the books of S Horsfield. Construct the manufacturing account for the year to 31 October 2014. Additional information: 1 Inventory as at 31 October 2014 was...

-

Which terms are used to determine severity of mental illness /Disorder in a DSM diagnosis? I Superficial, Typical, Intense Mild, Moderate, Severe Low, Medium, High Level I, Level II, Level II

-

Target Inventory You are the operations manager of a firm that uses the continuous inventory control system. Suppose the firm operates 50 weeks a year, 350 days, and has the following characteristics

-

Problem 1-47 (LO 1-3) (Algo) Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax rates? Taxpayer Mihwah...

-

Zephyr Minerals completed the following transactions involving machinery. Machine No. 1550 was purchased for cash on April 1, 2020, at an Installed cost of $83,000. Its useful life was estimated to...

-

Kelly is a self-employed tax attorney whose practice primarily involves tax planning. During the year, she attended a three-day seminar regarding new changes to the tax law. She incurred the...

-

Larned Corporation recorded the following transactions for the just completed month. a. $80,000 in raw materials were purchased on account. b. $71,000 in raw materials were used in production. Of...

-

After graduating from college and working a few years at a small technology firm. Preet scored a high-level job in the logistics department at Amex Corporation. Amex sells high-quality electronic...

-

Richard Company is preparing its multiple-step income statement, owner?s equity statement, and classified balance sheet. Using the column heads Account, Financial Statement, and Classification,...

-

Mr. Lucas has prepared the following list of statements about service companies and merchandisers. 1. Measuring net income for a merchandiser is conceptually the same as for a service company. 2. For...

-

Information related to Almond Co. is presented below. 1. On April 5, purchased merchandise from Morris Company for $23,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs...

-

1. Sunday pichaiah, the CC.O of google belongs to ans level of managment

-

Key Graphics expects to finish the current year with the financial results indicated on the worksheet given below. Develop next years income statement and ending balance sheet using that information...

-

Discuss briefly the key elements of the revised COSO Framework

Study smarter with the SolutionInn App