The Dinkle and Frizell Dental Clinic provides both preventive and orthodontic dental services. The two owners, Reese

Question:

The Dinkle and Frizell Dental Clinic provides both preventive and orthodontic dental services. The two owners, Reese Dinkle and Anita Frizell, operate the clinic as two separate investment centers: Preventive Services and Orthodontic Services. Each of them is in charge of one of the centers: Reese for Preventive Services and Anita for Orthodontic Services. Each month, they prepare an income statement for the two centers to evaluate performance and make decisions about how to improve the operational efficiency and profitability of the clinic.

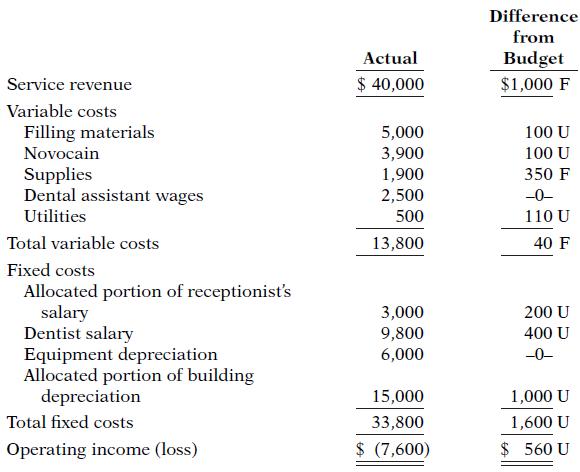

Recently, they have been concerned about the profitability of the Preventive Services operations. For several months, it has been reporting a loss. The responsibility report for the month of May 2017 is shown on page 1090.

In addition, the owners know that the investment in operating assets at the beginning of the month was $82,400, and it was $77,600 at the end of the month. They have asked for your assistance in evaluating their current performance reporting system.

Instructions

(a) Prepare a responsibility report for an investment center as illustrated in the chapter.

(b) Write a memo to the owners discussing the deficiencies of their current reporting system.

Step by Step Answer:

Accounting Principles

ISBN: 978-1118875056

12th edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso