A, B & C are partners sharing profits and losses in the ratio 2 : 2 :

Question:

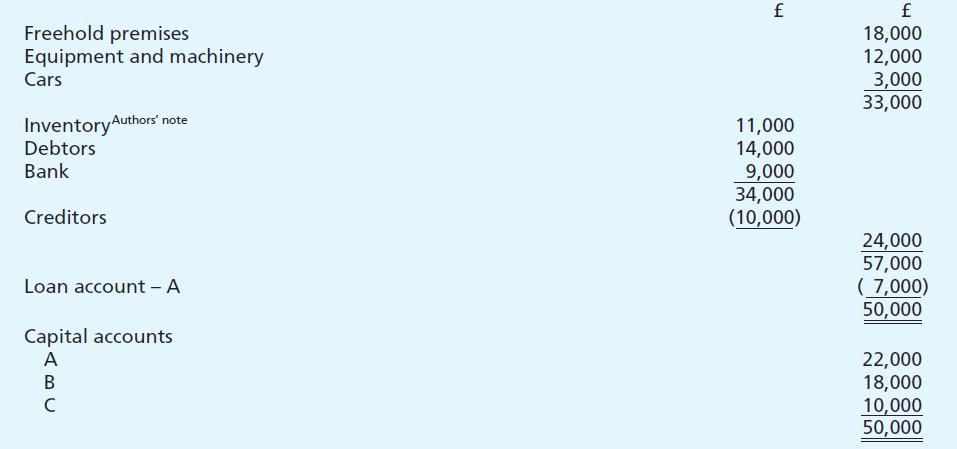

A, B & C are partners sharing profits and losses in the ratio 2 : 2 : 1. The balance sheet of the partnership as at 30 September 20X7 was as follows:

Authors’ note: Inventory is another word for stock. The partners agreed to dispose of the business to CNO Limited with effect from 1 October 20X7 under the following conditions and terms:

(i) CNO Limited will acquire the goodwill, all fixed assets and the inventory for the purchase consideration of £58,000. This consideration will include a payment of £10,000 in cash and the issue of 12,000 10 per cent preference shares of £1 each at par, and the balance by the issue of £1 ordinary shares at £1.25 per share.

(ii) The partnership business will settle amounts owing to creditors.

(iii) CNO Limited will collect the debts on behalf of the vendors.

Purchase consideration payments and allotments of shares were made on 1 October 20X7. The partnership creditors were paid off by 31 October 20X7 after the taking of cash discounts of £190.

CNO Limited collected and paid over all partnership debts by 30 November 20X7 except for bad debts amounting to £800. Discounts allowed to debtors amounted to £400.

Required:

(a) Journal entries (including those relating to cash) necessary to close the books of the partnership, and

(b) Set out the basis on which the shares in CNO Limited are allotted to partners. Ignore interest.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster