Grant and Herd are in partnership sharing profits and losses in the ratio 3 to 2. The

Question:

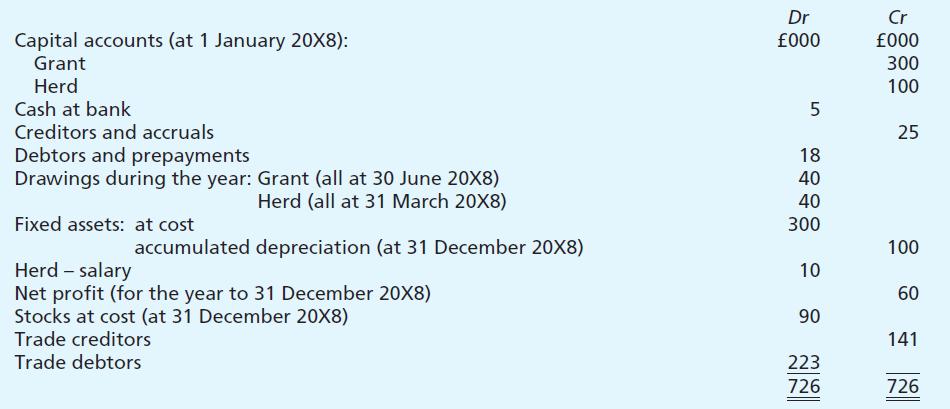

Grant and Herd are in partnership sharing profits and losses in the ratio 3 to 2. The following information relates to the year to 31 December 20X8:

Additional information:

1. The partnership agreement allows for Herd to be paid a salary of £20,000 per annum, and for interest of 5 per cent per annum to be paid on the partners’ capital account balances as at 1 January in each year. Interest at a rate of 10 per cent per annum is charged on the partners’ drawings.

2. The partners decide to dissolve the partnership as at 31 December 20X8, and the business was then sold to Valley Limited. The purchase consideration was to be 400,000 £1 ordinary shares in Valley at a premium of 25p per share. The shares were to be issued to the partners on 31 December 20X8, and they were to be shared between them in their profit-sharing ratio. The sale agreement allowed Grant to take over one of the business cars at an agreed valuation of £10,000. Apart from the car and the cash and bank balances, the company took over all the other partnership assets and liabilities at their book values as at 31 December 20X8.

3. Matters relating to the appropriation of profit for the year to 31 December 20X8 are to be dealt with in the partners’ capital accounts, including any arrears of salary owing to Herd.

Required:

(a) Write up the following accounts for the year to 31 December 20X8:

(i) The profit and loss appropriation account;

(ii) Grant and Herd’s capital accounts; and

(iii) The realisation account.

(b) Prepare Valley’s balance sheet as at 1 January 20X9 immediately after the acquisition of the partnership and assuming that no further transactions have taken place in the meantime.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster