Dinho and Manueli are in partnership sharing profits and losses equally after interest of 10% on each

Question:

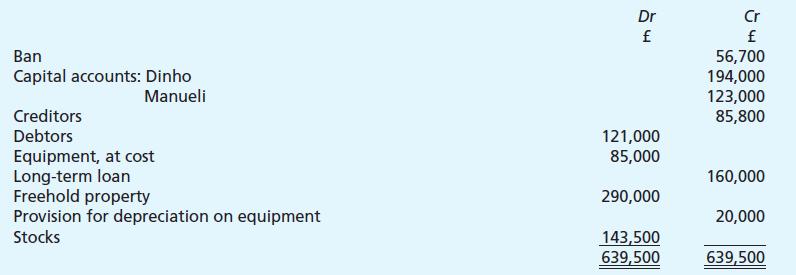

Dinho and Manueli are in partnership sharing profits and losses equally after interest of 10% on each partner’s capital account in excess of £100,000. At 31 December 20X8, the partnership trial balance was:

On 31 December 20X8, the partnership was converted to a limited company, Bin Ltd. All the partnership assets and liabilities were taken over by the company in exchange for shares in Bin Ltd valued at £304,000. The share capital was allocated so as to preserve the rights previously enjoyed by the partners under their partnership agreement.

The assets and liabilities and shares issued were all entered in the books of Bin Ltd at 31 December. In the company’s books, the debtors were recorded at £116,000 and the freehold property was valued at £260,000.

On 1 January 20X9, Pa invested £120,000 in the company and was issued shares on the same basis as had been applied when deciding the share allocations to Dinho and Manueli – i.e. as if he had been an equal partner in the partnership.

Pa had previously been an employee of the partnership earning £40,000 per annum. The £120,000 he invested in the company had been earning interest of 6% per annum from the bank. His salary will continue to be paid.

Assume that all profits will be paid as dividends. Ignore taxation.

Required:

(a) Prepare the partnership realisation account after the sale of the business to Bin Ltd had been completed and recorded in the partnership books.

(b) Prepare Bin Ltd’s balance sheet as at 1 January 20X9 after the purchase of shares by Pa.

(c) Calculate the annual profit that Bin Ltd needs to make before it pays any dividends if Pa is to receive the same amount of income as he was receiving before buying shares in Bin Ltd.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster