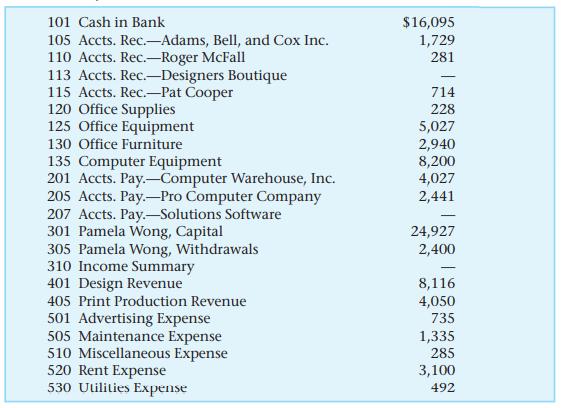

Glencoe Accounting First Year Course 1st Edition Andrée Vary - Solutions

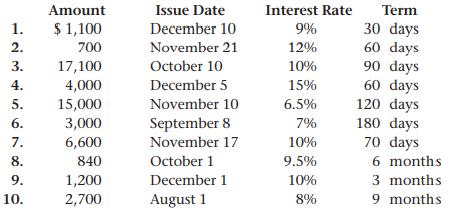

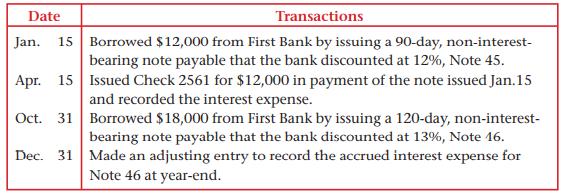

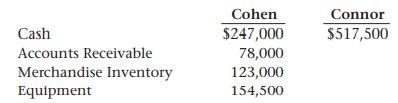

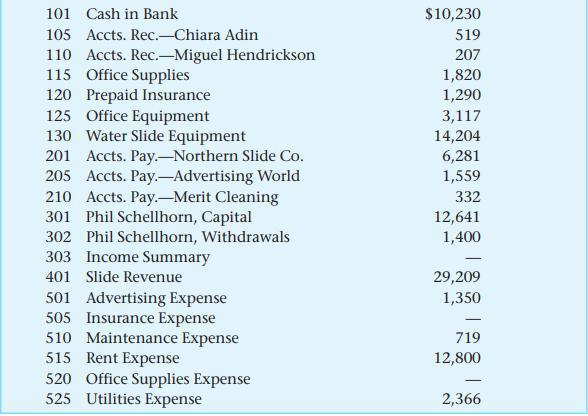

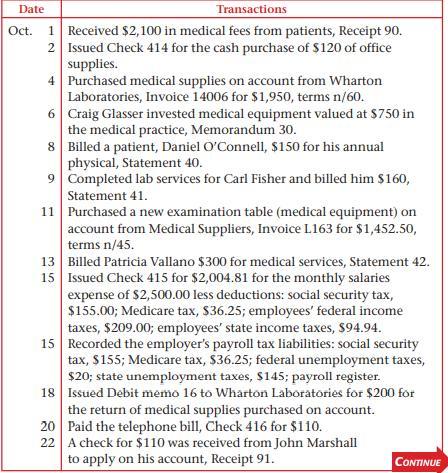

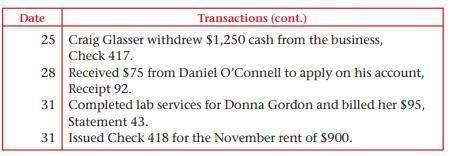

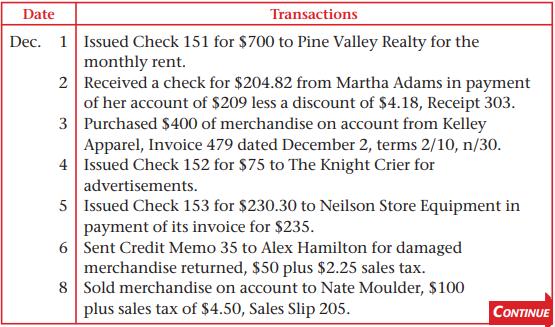

Unlock a comprehensive understanding of accounting with the "Glencoe Accounting First Year Course 1st Edition" by Andrée Vary. Access a wide range of solved problems and step-by-step answers online, tailored to enhance your learning journey. Our solution manual and answers key provide detailed solutions in PDF format, perfect for both students and instructors. Dive into our test bank and chapter solutions to reinforce your knowledge effectively. With our textbook resources, including the instructor manual and questions and answers, you'll gain a deeper insight into accounting principles. Enjoy the convenience of a free download to explore these invaluable resources at your fingertips.

![]()

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

![]()

![]()