A small retail business with a turnover of 20,000 p.a. has recently purchased the following items for

Question:

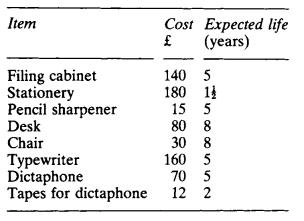

A small retail business with a turnover of £20,000 p.a. has recently purchased the following items for use in the general office:

Required:

(a) Explain which (if any) of these items would be treated as fixed assets (capitalized) and which as expenses of the year concerned.

(b) What is the consequence of the decision to capitalize or expense?

(c) Can you offer the business any general rules to guide them in their decision?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: