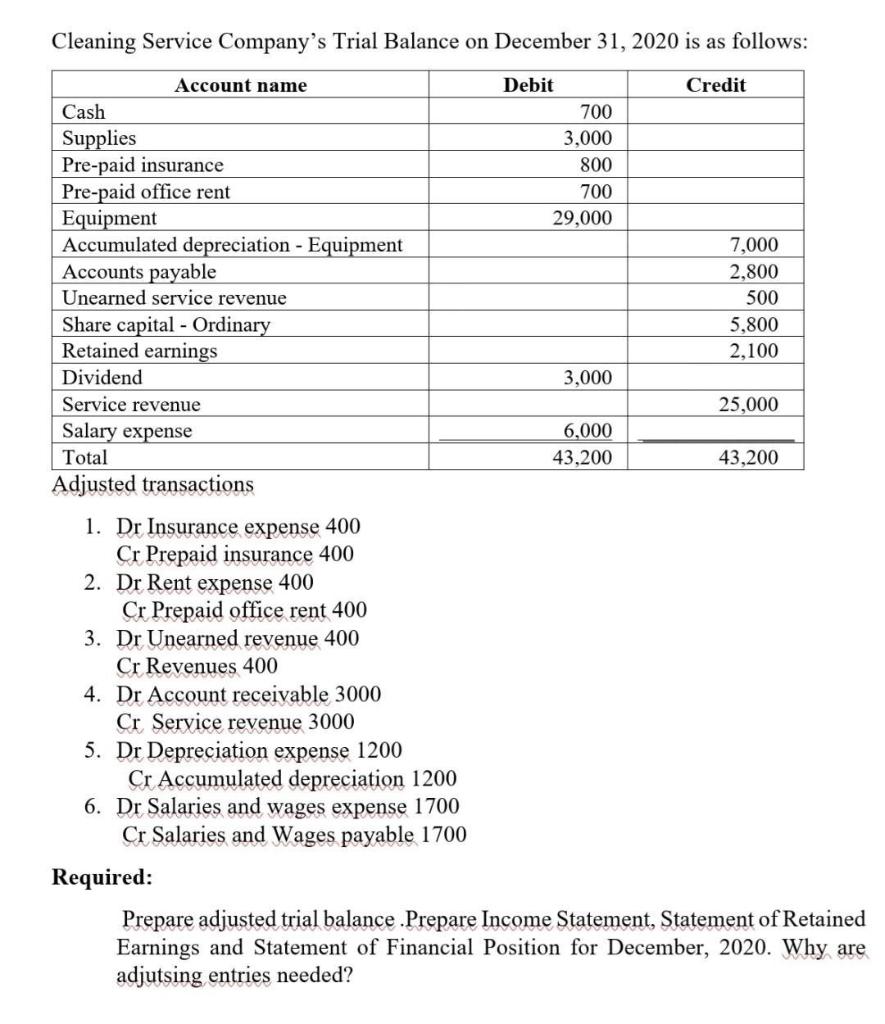

Cleaning Service Company's Trial Balance on December 31, 2020 is as follows: Account name Debit Credit Cash 700 Supplies Pre-paid insurance Pre-paid office rent

Cleaning Service Company's Trial Balance on December 31, 2020 is as follows: Account name Debit Credit Cash 700 Supplies Pre-paid insurance Pre-paid office rent Equipment Accumulated depreciation - Equipment Accounts payable Unearned service revenue 3,000 800 700 29,000 7,000 2,800 500 Share capital Ordinary Retained earnings 5,800 2,100 Dividend 3,000 Service revenue 25,000 Salary expense 6,000 Total 43,200 43,200 Adjusted transactions 1. Dr Insurance expense 400 Cr Prepaid insurance 400 2. Dr Rent expense 400 Cr Prepaid office rent 400 3. Dr Unearned revenue 400 Cr Revenues 400 4. Dr Account receivable 3000 Cr Service revenue 3000 5. Dr Depreciation expense 1200 Cr Accumulated depreciation 1200 6. Dr Salaries and wages expense 1700 Cr Salaries and Wages payable 1700 Required: Prepare adjusted trial balance .Prepare Income Statement, Statement of Retained Earnings and Statement of Financial Position for December, 2020. Why are adjutsing entries needed?

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Income statement For the year ended December 31 2020 Revenue Service revenue 28400 Operating Expense... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards