Amis, Lodge and Pym were in partnership sharing profits and losses in the ratio 5 : 3

Question:

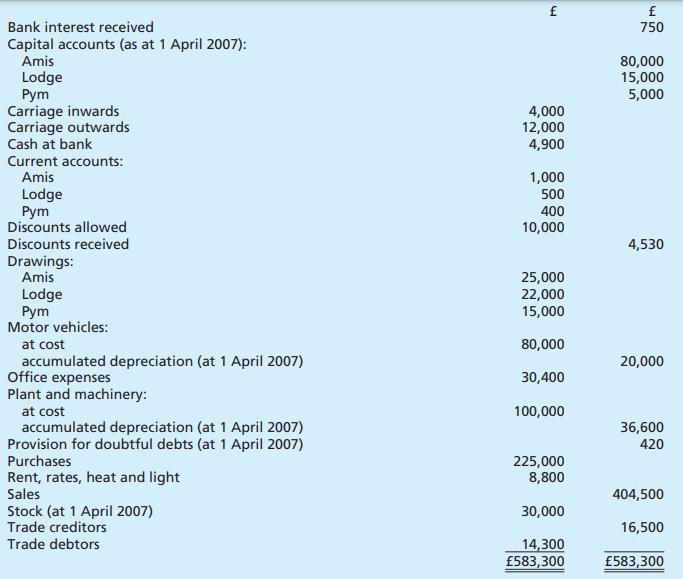

Amis, Lodge and Pym were in partnership sharing profits and losses in the ratio 5 : 3 : 2. The following trial balance has been extracted from their books of account as at 31 March 2008:

Transcribed Image Text:

f Bank interest received 750 Capital accounts (as at 1 April 2007): Amis Lodge 80,000 15,000 Pym 5,000 Carriage inwards Carriage outwards 4,000 12,000 Pym Cash at bank Current accounts: Amis Lodge Discounts allowed Discounts received Drawings: Amis 4,900 1,000 500 400 10,000 4,530 25,000 Lodge 22,000 Pym 15,000 Motor vehicles: at cost 80,000 accumulated depreciation (at 1 April 2007) 20,000 Office expenses 30,400 Plant and machinery: at cost 100,000 accumulated depreciation (at 1 April 2007) 36,600 Provision for doubtful debts (at 1 April 2007) 420 Purchases 225,000 Rent, rates, heat and light 8,800 Sales 404,500 Stock (at 1 April 2007) 30,000 Trade creditors Trade debtors 16,500 14,300 583,300 583,300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

Answered By

Madhur Jain

I have 6 years of rich teaching experience in subjects like Mathematics, Accounting, and Entrance Exams preparation. With my experience, I am able to quickly adapt to the student's level of understanding and make the best use of his time.

I focus on teaching concepts along with the applications and what separates me is the connection I create with my students. I am well qualified for working on complex problems and reaching out to the solutions in minimal time. I was also awarded 'The Best Tutor Award' for 2 consecutive years in my previous job.

Hoping to get to work on some really interesting problems here.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Business Accounting Uk Gaap Volume 1

ISBN: 9780273718765

1st Edition

Authors: Frank Wood, Alan Sangster

Question Posted:

Students also viewed these Business questions

-

Amis, Lodge and Pym were in partnership sharing profits and losses in the ratio 5 : 3 : 2. The following trial balance has been extracted from their books of account as at 31 March 2011: Additional...

-

Amis, Lodge and Pym were in partnership sharing profits and losses in the ratio 5 : 3 : 2. The following trial balance has been extracted from their books of account as at 31 March 2020: Additional...

-

Amis, Lodge and Pym were in partnership sharing profits and losses in the ratio 5 : 3 : 2. The following trial balance has been extracted from their books of account as at 31 March 20X8: Additional...

-

An examiners close inspection of the annual financial statements and the accounting records revealed that Mawani Inc. may have violated some accounting principles. The examiner questioned the...

-

On July 1, a portfolio manager holds $1 million face value of Treasury bonds, the 11 l/4s maturing in about 29 years. The price is 107 14/32. The bond will need to be sold on August 30. The manager...

-

Retrieve the annual report of American International Group (its ticker symbol is AIG), which owns a large consumer finance company, or select your own consumer finance company. To access income...

-

2. Pop acquired a 60 percent interest in Son on January 1, 2016, for $360,000, when Sons net assets had a book value and fair value of $600,000. During 2016, Pop sold inventory items that cost...

-

Refer to the financial statements of Quaker Oats Company in Problem. Prepare a forecasted income statement for Year 12 using the following assumptions ($ millions): 1. Revenues are forecast to equal...

-

7. An individual plans to invest $2,000 in a portfolio consisting of Stock A, Stock B, and Stock C. Stock A has an expected return of 8%, Stock B has an expected return of 12%, and Stock C has an...

-

Conversion cost per unit was} a. \(\$ 15\). b. \(\$ 21\). c. \(\$ 31\). d. \(\$ 16\). e. none of the above. Wachman Company produces a product with the following per-unit costs: Direct materials...

-

A, B and C are partners sharing profits and losses in the ratio 2 : 2 : 1. The balance sheet of the partnership as at 30 September 2007 was as follows: Authors Note: Inventory is another word for...

-

Suggest a synthesis of these ethers starting with an alcohol and an alkylhalide: OCH CH,CH a) CH,OCH,CH,CH,CH, b) c)

-

Obtain the phase trajectories for a system governed by the equation \[\ddot{x}+0.4 \dot{x}+0.8 x=0\] with the initial conditions \(x(0)=2\) and \(\dot{x}(0)=1\) using the method of isoclines.

-

Indicate whether each of the following accounts normally has a debit balance or a credit balance. a. Land b. Dividends c. Accounts Payable d. Unearned Revenue e. Consulting Revenue f. Salaries...

-

Indicate whether each of the following accounts normally has a debit or credit balance. a. Common Stock b. Retained Earnings c. Land d. Accounts Receivable e. Insurance Expense f. Cash g. Dividends...

-

Match each of the items in the left column with the LO5, 6 appropriate annual report component from the right column: 1. The company's total liabilities 2. The sources of cash during the period 3. An...

-

Allegra Company has sales of \($167,000\) and a bicak-even sales point of \($123,000\). Compute Allegra s margin of safety and its margin of safety ratio.

-

The following is an excerpt from a conversation between Sonia Lopez and Pete Lemke just before they boarded a flight to Paris on Delta Air Lines. They are going to Paris to attend their company's...

-

-x/2 x/4 If A = -x/2 and A-1 =6 then x equals

-

Compute the value of ordinary bonds under the following circumstances assuming that the coupon rate is 0.06:(either the correct formula(s) or the correct key strokes must be shown here to receive...

-

A tax-exempt municipal bond has a yield to maturity of 3.92%. An investor, who has a marginal tax rate of 40.00%, would prefer and an otherwise identical taxable corporate bond if it had a yield to...

-

Please note, kindly no handwriting. Q. Suppose a 3 year bond with a 6% coupon rate that was purchased for $760 and had a promised yield of 8%. Suppose that interest rates increased and the price of...

Study smarter with the SolutionInn App