As accountant for Capone Enterprises Ltd, a firm of soft drink distributors, you have received the following

Question:

As accountant for Capone Enterprises Ltd, a firm of soft drink distributors, you have received the following information about the performance of competitors in the trade:

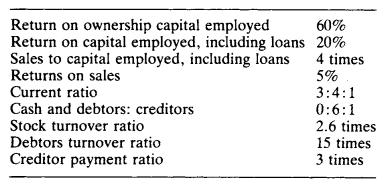

Return on ownership capital employed 60%

Return on capital employed, including loans 20%

Sales to capital employed, including loans 4 times Returns on sales 5%

Current ratio 3:4:1 Cash and debtors: creditors 0:6:1 Stock turnover ratio 2.6 times Debtors turnover ratio 15 times Creditor payment ratio 3 times Before the directors make policy decisions regarding their competitive position they would like you to explain what the above information means. (Note that they want to understand how meaningful the information is, rather than be given a detailed description of each ratio.)

They are particularly aware of the fact that, through a series of unfortunate accidents, their competitors have recently had to replace their fixed assets at the high prices now ruling, whereas Capone Enterprises is still utilizing fixed assets acquired cheaply some time ago, and they would like you to include in your explanations the effect of this on comparisons.

Historic cost is the basis of accounting throughout the trade, including Capone Enterprises Ltd.

Step by Step Answer: