Assume the company in Question 46.1 pays tax at 30 per cent, on 30 September each year,

Question:

Assume the company in Question 46.1 pays tax at 30 per cent, on 30 September each year, nine months after the end of its financial period. The company receives 20 per cent writing-down allowances on the cost of equipment and will receive the allowances for 20X4 expenditure to be offset against the tax payable on the profits for 20X4. 100 per cent capital allowances were received on the old equipment sold in 20X5 and the receipts from the sale of the old equipment must, therefore, be treated as taxable income of 20X5. Show the impact on the cash flows of these tax items.

Data from Question 46.1

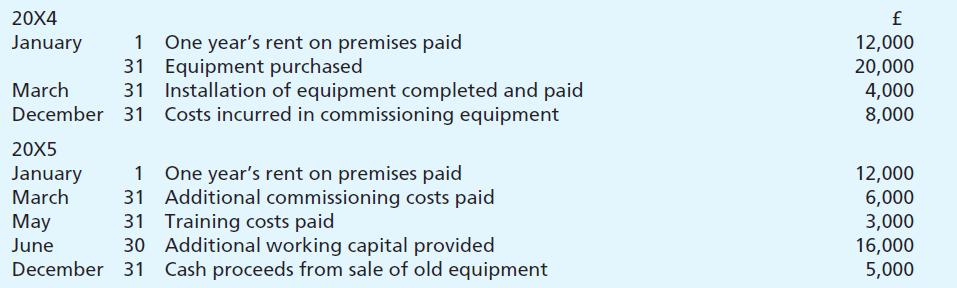

The following project costs have been estimated relating to the upgrading of some equipment; all the costs are being incurred solely because of the project:

Ignoring tax, prepare a statement showing the outlays of cash on the project in 20X4 and 20X5. The new facility will be in full use from 1 July 20X5.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster