The following project costs have been estimated relating to the upgrading of some equipment; all the costs

Question:

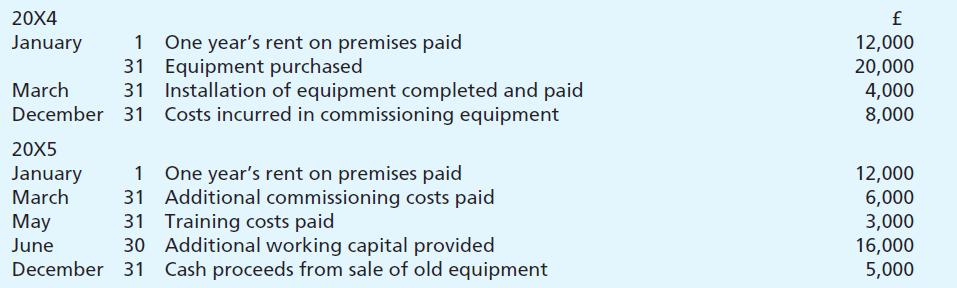

The following project costs have been estimated relating to the upgrading of some equipment; all the costs are being incurred solely because of the project:

Ignoring tax, prepare a statement showing the outlays of cash on the project in 20X4 and 20X5. The new facility will be in full use from 1 July 20X5.

Transcribed Image Text:

20X4 January March December 20X5 January March One year's rent on premises paid 31 Equipment purchased 31 Installation of equipment completed and paid 31 Costs incurred in commissioning equipment May June One year's rent on premises paid Additional commissioning costs paid Training costs paid Additional working capital provided 31 30 December 31 Cash proceeds from sale of old equipment £ 12,000 20,000 4,000 8,000 12,000 6,000 3,000 16,000 5,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

20X4 Date Description Cash Flow January One years rent on premi...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster

Question Posted:

Students also viewed these Business questions

-

Assuming an interest rate of 6 per cent, what is the net present value of the net of tax cash flows in Question 46.2 for 20X4, 20X5, 20X6 and 20X7? Data from Question 46.2 Assume the company in...

-

Assume the company in Question 46.1 pays tax at 30 per cent, on 30 September each year, nine months after the end of its financial period. The company receives 20 per cent writing-down allowances on...

-

Over the past few years, officials in Florida and other states that rely primarily on deep wells for drinking water have become aware of a potentially serious problem-the pollution of aquifers by the...

-

1. A projectile is launched in a vertical plane, at an angle 0 with initial velocity vo. It must be caught in a frictionless circular tube of radius R in such a way that the trajectory of the...

-

In the kinked demand model, what is assumed about rival responses to price increases? Price decreases? What does that imply about anticipated elasticities of demand as a result?

-

P17-8B The comparative balance sheet of Shin-Etsu Chemical Company at June 30, 20x2. included the following balances: SHIN-ETSU CHEMICAL COMPANY Balance Sheet June 30, 20X2 and 20X1 20X2 20X1...

-

Fighting cancer. Congress wants the medical establishment to show that progress is being made in fighting cancer. Here are some variables that might be used: 1. Total deaths from cancer. These have...

-

Mississippi Manufacturing, Inc., reported the following at December 31, 2014 and December 31, 2015: Stockholders Equity Preferred stock, cumulative, $2.00 par, 6%, 70,000 shares issued .... $ 140,000...

-

4. Verizox Company uses a job order cost system with manufacturing overhead applied to products based on direct labor hours. At the beginning of the most recent year, the company estimated its...

-

Major Project - Andrew Best - Best Business Solutions Incorporated (BBSI) Andrew Best was a very inquisitive child growing up. He was a great student in school and always asked a lot of questions....

-

If you had 5,000 to spend today and had the choice of investing it in a five year bond with a bank, or lending it to a friend who had just opened a restaurant and who offered you 10 per cent of the...

-

The annual rental payments on a five-year lease are 11,000. If the rate of interest payable on borrowing for this purpose is 9 per cent, what is the capital value of the lease?

-

A cylinder fitted with a movable piston contains water at 3 MPa, 50% quality, at which point the volume is 20 L. The water now expands to 1.2 MPa as a result of receiving 600 kJ of heat from a large...

-

Hardwick Corporation manufactures fine furniture for residential and industrial use. The demand for the company's products has increased tremendously in the past three years. As a result, the company...

-

Problem 3: Use the product rule to find the following derivatives. Leave your answer in the form f'(x)g(x)+ f (x) g' (r). That is, do not simplify. (a) s(t)=t3 cos (t) (b) F(y): = (12-1) (v + 5 y)...

-

Do an internet search of two or three organizations in your field of study (Human Resources). Review the organization or business and its hiring practices using some of the questions from the...

-

4. A process was set to meet the design specifications of USL = 26 and LSL = 18. The standard deviation of the process was found to be 1.2. The process mean was set to 22.5. a) Calculate the process...

-

Evaluate the broad environment, e.g., political, social, legal, in which the industry of OCSIP is located. How does this affect the industry?

-

The Dr. Fisher's Casebook feature "Codex magistri Piscatori," appearing in an issue of Significance Magazine (Vol. 10, Issue 2, p. 28), showed an image, including the probability, of a "Venus throw,"...

-

Cleaning Service Company's Trial Balance on December 31, 2020 is as follows: Account name Debit Credit Cash 700 Supplies Pre-paid insurance Pre-paid office rent Equipment Accumulated depreciation -...

-

The following information relates to Grigg plc: 1. On 1 April 20X8 the company had 100,000 10 per cent debentures in issue. The interest on these debentures is paid on 30 September and 31 March. 2....

-

CJK Ltd was incorporated on 15 December 20X9 with an authorised capital of 200,000 ordinary shares of 0.20 each to acquire as at 31 December 20X9 the business of CK, a sole trader, and RP Ltd, a...

-

Chess Ltd was incorporated on 1 September 20X4 and took over the business of Red and Green on 1 June 20X4. It was agreed that all profits made from 1 June should belong to the company and that the...

-

Comfort Golf Products is considering whether to upgrade its equipment Managers are considering two options. Equipment manufactured by Stenback Inc. costs $1,000,000 and will last five years and have...

-

Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 71,000 shares of $10 par common stock. 8,500 shares of $60 par, 6 percent, noncumulative preferred stock. On...

-

Read the following case and then answer questions On 1 January 2016 a company purchased a machine at a cost of $3,000. Its useful life is estimated to be 10 years and then it has a residual value of...

Study smarter with the SolutionInn App