Bunker plc is a trading company; it does not carry out any manufacturing operations. The following information

Question:

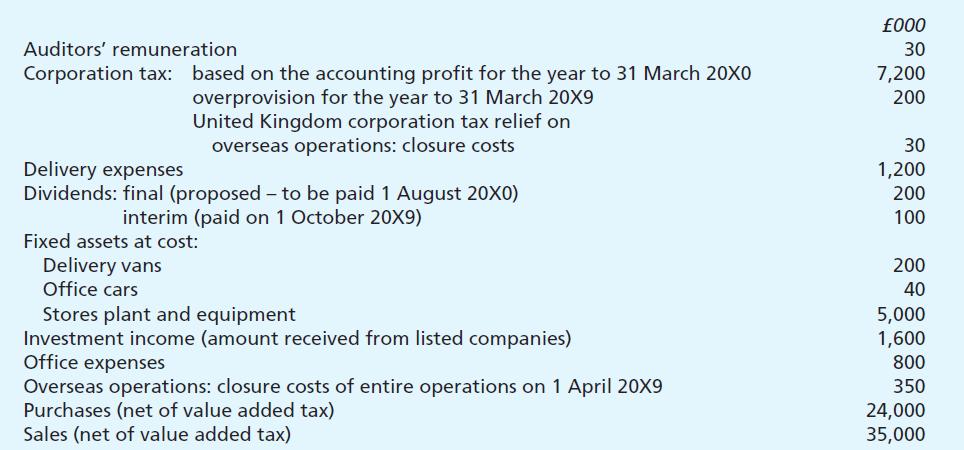

Bunker plc is a trading company; it does not carry out any manufacturing operations. The following information has been extracted from the books of account for the year to 31 March 20X0:

Additional information:

1. Depreciation policy:

Depreciation is provided at the following annual rates on a straight line basis: delivery vans 20 per cent; office cars 7.5 per cent; stores plant and equipment 10 per cent.

2. The following taxation rates may be assumed: corporation tax 35 per cent; income tax 25 per cent; value added tax 15 per cent.

3. The investment income arises from investments held in fixed asset investments.

4. It has been decided to transfer an amount of £150,000 to the deferred taxation account.

5. There were 1,000,000 ordinary shares of £1 each in issue during the year to 31 March 20X0. There were no preference shares in issue.

Required:

In so far as the information permits, prepare Bunker plc’s published profit and loss account for the year to 31 March 20X0 in accordance with the minimum requirements of the Companies Act 1985 and related accounting standards.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster