The following information has been extracted from the books of account of Rufford plc for the year

Question:

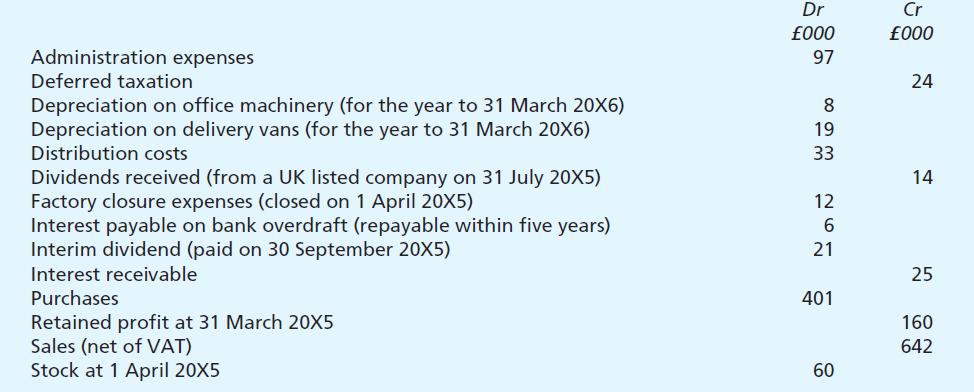

The following information has been extracted from the books of account of Rufford plc for the year to 31 March 20X6:

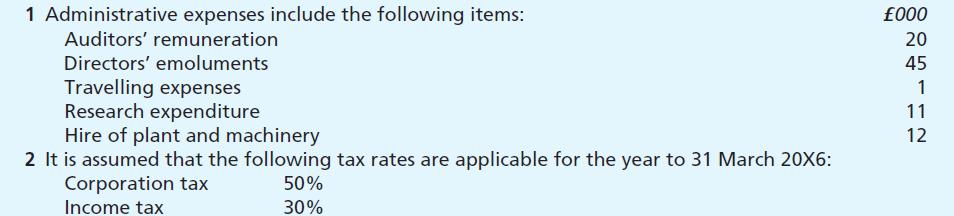

Additional information:

3. There was an overprovision for corporation tax of £3,000 relating to the year to 31 March 20X5.

4. Corporation tax payable for the year to 31 March 20X6 (based on the profits for that year) is estimated to be £38,000. The company, in addition, intends to transfer a further £9,000 to its deferred taxation account.

5. A final dividend of £42,000 for the year to 31 March 20X6 is expected to be paid on 2 June 20X6.

6. Stock at 31 March 20X6 was valued at £71,000.

7. As a result of a change in accounting policy, a prior period charge of £15,000 (net of tax) is to be made.

8. The company’s share capital consists of 420,000 ordinary shares of £1 each. There are no preference shares, and no change had been made to the company’s issued share capital for some years.

Required:

(a) In so far as the information permits, prepare the company’s published profit and loss account for the year to 31 March 20X6 in the vertical format in accordance with the Companies Act and with related accounting standards.

(b) Prepare balance sheet extracts in order to illustrate the balances still remaining in the following accounts at 31 March 20X6:

(i) Corporation tax;

(ii) Proposed dividend; and

(iii) Deferred taxation.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster