Exercises (a) to (e) are based on the following statement of financial position. Note also that each

Question:

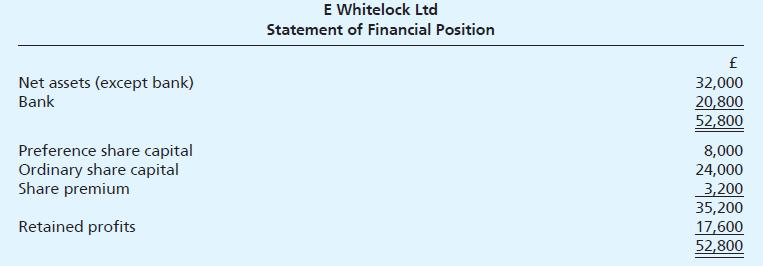

Exercises (a) to (e) are based on the following statement of financial position.

Note also that each of exercises (a) to (e) is independent of any other. The exercises are not cumulative.

Required:

(a) E Whitelock Ltd redeems £8,000 preference shares at par, a new issue of £8,000 ordinary shares at par being made for the purpose. Show the statement of financial position after completion of these transactions. Workings are to be shown as journal entries.

(b) E White lock Ltd redeems £8,000 preference shares at par, with no new issue of shares to provide funds. Show the statement of financial position after completing the transaction. Workings: show journal entries.

(c) E White lock Ltd redeems £8,000 preference shares at par. To help finance this an issue of £2,400 ordinary shares at par is effected. Show the statement of financial position after these transactions have been completed; also show the necessary journal entries.

(d) E White lock Ltd redeems £8,000 preference shares at a premium of 20%. There is no new issue of shares for the purpose. In this question the share premium account is taken as being from the issue of ordinary shares some years ago. Show the statement of financial position after these transactions have been completed, and the supporting journal entries.

(e) E White lock Ltd redeems £8,000 preference shares at a premium of 30%. There is an issue of £10,400 ordinary shares at par for the purpose. The preference shares had originally been issued at a premium of 25%. Show the statement of financial position after these transactions have been completed, and also the supporting journal entries.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster