Far East Ltd is a manufacturing company which uses a variety of machines for its production programme.

Question:

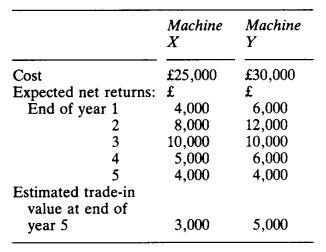

Far East Ltd is a manufacturing company which uses a variety of machines for its production programme. One of the machines has now to be replaced and the management of the company are considering which of two alternative machines should be acquired.

Details of the two machines (each of which has an estimated life of five years), and of the expected net return directly referable to them, are as follows:

Machine X Machine Y Cost £25,000 £30,000 Expected net returns: £ £

End of year 1 4,000 6,000 2 8,000 12,000 3 10,000 10,000 4 5,000 6,000 5 4,000 4,000 Estimated trade-in value at end of year 5 3,000 5,000 Required:

(a) Calculate which of the two machines is likely to yield the better returns (based on discounted present value), using (i) 10 per cent and (ii) 15 per cent as the required rate.

(b) By interpolation, ascertain the true rate of interest for each machine.

(c) Comment briefly, in light of your answers to (a), on the problems arising from the use of discounted present value as a criterion for investment decisions.

Notes:

(i) Ignore taxation.

(ii) Except where otherwise indicated, assume that all inflows and outflows of cash take place at the end of the appropriate years.

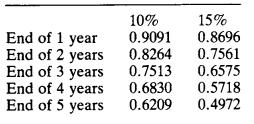

(iii) The following table shows the present value of £1 , using the rates of interest and the relevant years required by the question:

10% 15%

End of 1 year 0.9091 0.8696 End of 2 years 0.8264 0.7561 End of 3 years 0.7513 0.6575 End of 4 years 0.6830 0.5718 End of 5 years 0.6209 0.4972

Step by Step Answer: